| RBI rate hike to ease inflationary pressure: FM |

Welcoming the Reserve Bank’s decision to hike key rates by a hefty 50 basis points, Finance Minister Pranab Mukherjee said it will help bring down inflation to a comfortable level of 6-7 per cent by year-end.

"The Reserve Bank of India has sought to give a strong signal to further moderate inflation and check inflationary expectations," Mukherjee said.

Inflation has remained stubbornly close to double-digit levels during the first quarter of the current fiscal.

Mukherjee said the RBI rate hike was necessary to bring down inflation to an acceptable level at the earliest.

Overall wholesale price-based inflation stood at 9.44 per cent in June. To tame the inflation monster, the RBI on Tuesday hiked key policy rates by 50 basis points.

"With this policy adjustment, we will be able to get back to a more comfortable inflation situation that takes us to the year-end inflation level of 6 to 7 per cent," Mukherjee added.

The RBI has hiked its policy rates 11 times since March, 2010, to curb inflation. However, the problem persists.

Mukherjee said although food inflation has moderated in recent months, pressure in manufactured items has hardened.

While coming out with its first quarterly policy review for the 2011-12 financial year, the RBI admitted that there has been a moderation in growth, but maintained its previous estimate of 8 per cent GDP growth for the current fiscal.

Mukherjee said, "The overall GDP growth for 2011-12 so far is in line with the momentum attained in 2010-11."

There have been concerns that the country's economic growth could see some moderation on the back of a deceleration in factory output growth in April-May.

| Inflation Accelerates RBI Rate Hike Seen |

Inflation accelerated faster than expected in May, with higher manufacturing prices offsetting slower growth in fuel and food costs and adding pressure on the RBI to lift interest rates this week despite signs of economic slowdown.

The wholesale price index, India's main inflation gauge, rose an annual 9.06 per cent in May, above the median forecast for an 8.70 per cent rise in a Reuters poll and the April figure of 8.66 per cent.

"The big surprise is mainly because of the sharp increase in manufacturing prices which implies that core inflation is picking up. This cements the case for a 25 basis points rate hike on Thursday," said Nomura economist Sonal Varma.

Headline inflation for March was revised up to 9.68 percent from an earlier reported 9.04 percent, continuing a recent trend of sharp upward revisions.

Annual manufacturing inflation in May was 7.27 per cent, up from 6.18 percent in April, while annual fuel price inflation eased to 12.32 per cent from 13.32 per cent in April despite an increase in domestic gasoline prices in mid-May.

Sluggish investment, which was essentially flat in the March quarter on rising rates and slow government approvals of big projects after growing an annual 7.8 per cent in the previous three months, has exacerbated tight industrial capacity.

Consumer demand, meanwhile, eased more slowly, growing at 8 per cent in the March quarter from 8.6 percent on an annual basis in the previous quarter.

Fuel inflation has remained elevated as global hovers around $120 per barrel, which may prompt New Delhi to raise prices of diesel, cooking gas and kerosene, which would be politically unpopular in a country where nagging inflation has prompted protests and put the ruling Congress party on the defensive.

"The number is much higher than expected and a breach of the 9 percent mark without a diesel price revision and in a month when global commodity prices were softer highlights the underlying inflationary pressure in the economy," said Anubhuti Sahay, Economist with Standard Chartered Bank.

The benchmark 7.80 percent 2021 bond yield immediately rose 3 basis points to 8.33 percent after higher than expected inflation data.

The 5-year overnight indexed swap rate rose 4 basis points to 7.80 percent and the 1-year was 6 basis points higher at 8.02 percent after the data, dealers said.

The BSE Sensex trimmed gains to 0.22 per cent from 0.4 per cent before hand.

Rate Hike Seen

Despite most indicators showing signs of slowing growth, including worse-than-expected GDP growth of 7.8 percent in the March quarter, the Reserve Bank of India is expected to lift policy rates by 25 basis points on Thursday in what would be its tenth rate increase since March 2010.

"I think the RBI will probably look at the inflation issue more seriously," C. Rangarajan, the chairman of the Prime Minister's Economic Advisory Council, said on Tuesday.

However, weakening conditions globally and in Asia's third-largest economy may temper the RBI's recently hawkish policy stance in coming months.

On Tuesday, China reported consumer price inflation of 5.5 percent for May, its highest in nearly three years, and raised reserve requirements for banks in an effort to tame prices.

Signs of Slowdown

Recent indicators point to slowing growth in India.

The index of industrial output for April grew 6.3 per cent, the slowest in 3 months with growth in the capital goods sector slowing to just over 14 percent in April.

Car sales rose 7 percent in May, the slowest in two years, and analysts expect a further decline as higher fuel prices, interest rates and vehicle costs crimp demand in the world's second-fastest growing vehicle market.

Credit growth has remained almost flat in the current financial year that started in April, with banks' loans growing only 0.3 percent since March end.

Policymakers have scaled back growth projections for the current fiscal year from 9 percent earlier to around 8.5 percent, with many private forecasts predicting growth below 8 percent as rising rates and sluggish investment take a toll.

RBI Governor Duvvuri Subbarao said early last month that some near-term growth should be sacrificed to tame high inflation, although global and domestic conditions have deteriorated since then.

Government officials have expressed concern that slowing growth will make it hard for India to meet its revenue targets for the year, which will in turn add make it harder to meet its goal of trimming the fiscal deficit.

| Possibility of further rate hike due to inflation: RBI |

The Reserve Bank said the option of going for another round of rate hike at its next mid-quarterly policy review in September do exist as inflationary pressure continues in the economy.

"Probability is always there," RBI Deputy Governor K C Chakraborty said here today when asked whether another rate hike was possible as inflation is still ruling over 9%. He was speaking on the sidelines of the diamond jubilee celebration of the Reserve Bank employees' sports club.

Chakraborty said the short-term target is to bring down headline inflation to 6% to 7% and further ease it to 3% to 4% in the medium-to-long term. When asked if the RBI is equipped to supervise micro finance sector if asked by the government, he said, "If we are not equipped, then we have to improve our capacity (to do so). Let the bill be first approved".

On banks not giving loans to the MFI sector, Chakraborty said, "We cannot force them but we are asking them".

| Indian inflation: Bringing tears to Indians' eyes HEADLINES about the Indian economy—particularly in the international press—have in recent times been dominated by excitement about near double-digit growth and speculation about when (and whether) India is on track to start growing faster than China. But domestically, (and now elsewhere, too) the big economic—and increasingly political—issue is a familiar one: runaway inflation. The Indian press is obsessively following the price of onions, which saw a massive spike at the end of last year and the beginning of this one. On Twitter, Indians have noted sarcastically that at one point last week, the prices of a kilo of onions, a litre of petrol and a bottle of beer (presumably in some places, since alcohol taxes vary a lot by state because of state-level taxes) were all the same. Onions get a lot of attention in India partly because many people believe that they’re one of the things that even the poorest Indians buy (along with rice or wheat, cooking oil and salt). There’s a stereotypical image of a very poor person in India subsisting on a couple of rotis, a pinch of salt, and some raw onions for flavour. (Actually the stereotype of really dire poverty is that meal, minus even the onions—“two dry rotis with a pinch of salt” is the North Indian shorthand for being in really dire straits). So the idea of onions becoming absurdly pricey has a certain political charge. And onion prices do reflect a broader trend. Food inflation is in double digits, and overall wholesale-price inflation (WPI, which, rather oddly, is the measure policymakers in the country follow) is in the high single-digits. December’s annual WPI inflation rate was 8.4%, up from 7.5% in November. This makes India something of an anomaly globally. In rich countries (with the possible exception of Britain), deflation remains the bigger worry, but India’s inflation is also substantially higher than in other emerging economies. It’s worth noting, though, that for all the noise around inflation in India recently, it’s not as though overall inflation has spiked all of a sudden. The recent inflation figures are in fact relatively low, at least compared with the rest of last year. December’s 8.4% WPI inflation was in fact the second-lowest of last year; from March to July inflation was over 10%. So in a sense, perhaps the real question ought not to be why inflation is high now, but why India seems to have chronically high inflation. Kalpana Kochhar, a senior official at the IMF’s Asia desk argues that India is a chronically supply-constrained economy, with chronic excess demand. In the course of the economic cycle, therefore, price pressures tend to be exaggerated. It’s worth noting that in the middle of 2009, Indian policymakers were debating whether the country was likely to fall into persistent deflation. WPI inflation was in fact negative year-on-year in June and July last year, and below 2% for every month between March and September. So rather than call India a persistently high-inflation economy, it may be better to think of it as a country where inflation is relatively more volatile through the business cycle than in other countries. Some excellent historical perspective can be found in this speech made in September last year by Deepak Mohanty, the executive director of the Reserve Bank of India. (That speech is also a great primer on how Indian WPI inflation is calculated; Mr Mohanty was making it soon after the basket was revised. Among other changes, the weighting of food products in the basket used to calculate the WPI was reduced last year to 24.3% from 26.9 %.) Mr Mohanty notes that the recent period of high inflation is not exactly historically unprecedented, though to be fair it is clearly not the norm. Going by the current experience of 5-6 months of double digit inflation as high, one can trace 9 such episodes in the last 56 years. Out of these 9 episodes, double digit inflation lasting beyond a year occurred on 5 occasions. The most prolonged one lasted for 30 months during October 1972 to March 1975. The last such high inflation was in the mid-1990s which lasted 15 months between March 1994 and May 1995. It doesn’t help that Indian agricultural output is very volatile, partly because of poor infrastructure, bad supply chains, poor storage facilities, and the like. This means that changes in weather conditions or other factors affecting output can lead to really large price fluctuations. In the case of onions, unseasonal rain in October that destroyed crops in Maharashtra appears to be the main culprit. It's worth noting, also, that India's consumer-price index has an much higher weight on food products compared with other countries, and CPI inflation has been running ahead of WPI inflation. Mr Mohanty has a nifty table summarizing the causes of the periods of high inflation. Drought features prominently. For the most recent episode, he also blames the rise in global commodity prices. But it also appears to me that Indian policymakers tend to underestimate this trend. In April 2009, the governor of the country’s central bank was quoted as saying that he expected WPI inflation to be at 4% in March 2010. In fact, it was 10.2% that month, and stayed at or above 10% in every month till July. And while the RBI does not formally target inflation, there are plenty who think that it has been too slow to tighten monetary policy. It has in fact been raising rates regularly since March last year, but only very gradually. Some reckon it should have tightened faster. The RBI is, of course, wary of choking off India’s rapid recovery from the slowdown in growth during the global economic crisis. Its governor, D Subbarao, said on January 17th that "For the Reserve Bank the challenge is to calibrate monetary policy taking into account the demands of inflation management and the demand of supportive recovery”. Meanwhile, the usual problems with persistently high inflation are being felt, and not just by those buying onions. Indian banks are seeing rising loan-to-deposit ratios as savers move their money into perceived inflation hedges like gold and property. Bank deposits increased by 16.5% in the two weeks ended December 31 from a year earlier, lagging a 24.4% increase in lending, according to RBI data. "The shift of the Indian household sector from deposits to inflation hedges such as property and gold is creating a liquidity crunch in the banking sector that’s unlikely to be solved in the near future,” Kristine Li, senior director of Asia-Pacific credit strategy at Royal Bank of Scotland Group Plc, told Bloomberg. “If banks’ loan growth decelerates, asset quality concerns are likely to return.” More broadly, though, I sense that for all the sound and fury, the political tolerance for a period of high inflation has risen. I suspect this is to do with the fact that earlier episodes of high inflation in India occurred in an economy where income per head rose very sluggishly indeed. Now, with real rates of economic growth near 9%, and slower population growth than before, real incomes are rising fast enough that people are willing to put up with high inflation for some time. Of course, high inflation for a long period also risks damaging the growth story. But for the moment it appears Indian policymakers are content to wait for short-term supply constraints to ease, while continuing to tighten roughly at the pace they’ve been doing. K.C. Chakraborty, deputy governor of the RBI, said on January 11 that inflation was in a difficult situation but manageable.

|

The Factors Affecting InflationBy inflation one generally means rise in prices. To be more correct inflation is persistent rise in the general price level rather than a once-for-all rise in it, while deflation is persistent falling price. These days economies of all countries whether underdeveloped, developing as well developed suffers from inflation. Inflation or persistent rising prices are major problem today in world. Because of many reasons, first, the rate of inflation these years are much high than experienced earlier periods. Second, Inflation in these years coexists with high rate of unemployment, which is a new phenomenon and made it difficult to control inflation. Depending upon the reason of inflation, it can be divided in many types as (1.) Demand-Pull inflation, (2) Cost-Push inflation, (3) Structural inflation. Inflation is very unpopular happening in an economy. Opinion survey conducted in India, USA and many other countries reveal that inflation is the most important concern of the people as it badly affects their standard of living. So why it is called Inflation is enemy number one. As India is also facing same problem let’s find out the causes of inflation and the measure which the RBI using to curb it as rising CRR, repo rate, reverse repo rate etc will do as planned by RBI or need to use some other tools. And to compare it with context of other economies problem. The data for analysis will be collected from different surveys done by RBI and economic surveys and other surveys and also from the survey reports of other countries to compare it globally. INTRODUCTION By inflation mean a process of rising prices. A situation is described as inflationary when either the prices or the supply of money are rising, but in practice both will rise together. In the Keynesian sense True inflation begins when the elasticity of supply of output in response to increase in money supply has fallen to zero or when output is unresponsive to changes in money supply. If there is full employment then condition will of clearly inflationary, if there is increase in the Money Supply.

Depending upon the reason of inflation, it can be divided in many types as (1.) Demand-Pull inflation: This represents a situation where there is increase in Aggregate Demand for resources either from the government or the entrepreneurs or the households. Result of this is that the pressure of Demand can’t be met by the Currently available Aggregate Supply which result in Aggregate Demand > Aggregate Supply which is bound to generate inflationary pressure in the economy. (2.) Cost-Push inflation: This represents the condition where even though there is no increase in Aggregate Demand, prices may still rise. This may happen if the costs of especially wage cost rise. (3.) Structural inflation: This type of inflation occurs because of change in structure of economies as happened in India from Agricultural Structure i.e. Green Revolution to Industrialization. Thus because of change in Economic Structure gives rise to increase in prices thus generate inflationary pressure. Inflation is very unpopular happening in an economy. Opinion survey conducted in India, USA and many other countries reveal that inflation is the most important concern of the people as it badly affects their standard of living. So why it is called Inflation is enemy number one. India is facing the problem of inflationary pressure because of the increase in Aggregate Demand while Aggregate Supply is respectively constant. The inflationary pressure faced by Indian Economy is due to Demand-Pull inflation i.e. Aggregate Demand > Aggregate Supply. Thus to curb inflation need to fill the gap between Aggregate Demand and Aggregate Supply. For this either need to increase AS or decrease AD that can hamper economic development. Thus to increase AS is the best tool which can be used. To increase AS either need to increase production capacity of all current production units of two built new production plants. But as quoted in an survey done by RBI that all the production plants are running at their full production capacity thus all resources all-full employed the other way is to built new plant but to do this will take at least 18months to 2years. Thus meanwhile need to decrease Money Supply, which is opted by RBI. As in short run it’s not possible to meet the gap between AD and AS thus RBI is planning to decrease liquidity by reducing Money Supply from the market. For this it has been planned that by decreasing CRR, repo rate and reverse repo rate Liquidity from the market will be drained. CRR i.e. Cash Reserve Ratio is the percentage of deposit that a commercial bank need to keep with RBI by which RBI control liquidity in the market and create Money Supply.

Repo Rate: is the rate at which RBI lends money to other commercial Banks. RBI planned that Liquidity from the market can be drained by decreasing money supply and to do so it is increasing CRR, repo rate, reverse repo rate and taking other measure like that. But interest is that whether hike to cry and other factors will curb inflation and what are the other factors, which are influencing inflation. My purpose of study is that every country faces the problem of inflation whether developed, underdeveloped or developing. Here I want to concentrate whether the Indian Government and RBI taking the measures to curb inflation are correct or not? Will it actually bring down the prices? Because this is not only of our government or of a particular country but globally faced and the principles on which economy works are same for all the economies. By this research, it will be beneficial not only for Indian context but for all countries as on this my whole emphasis is on the causes of inflation and measures to control it and whether the measure taken by RBI is effective or not? OBJECTIVE India is facing the problem of inflationary pressure because of the increase in Aggregate Demand while Aggregate Supply is respectively constant. The inflationary pressure faced by Indian Economy is due to Demand-Pull inflation i.e. Aggregate Demand > Aggregate Supply. Thus to curb inflation need to fill the gap between Aggregate Demand and Aggregate Supply. For this either need to increase AS or decrease AD that can hamper economic development. Inflation is very unpopular happening in an economy. Opinion survey conducted in India, USA and many other countries reveal that inflation is the most important concern of the people as it badly affects their standard of living. So why it is called Inflation is enemy number one. RBI planned that Liquidity from the market can be drained by decreasing money supply and to do so it is increasing CRR, repo rate, reverse repo rate and taking other measure like that. But interest is that whether hike to cry and other factors will curb inflation and what are the other factors, which are influencing inflation. Every country faces the problem of inflation whether developed, underdeveloped or developing. Whether the Indian Government and RBI taking the measures to curb inflation are correct or not? Will it actually bring down the prices? Because this is not only of our government or of a particular country but globally faced and the principles on which economy works are same for all the economies. |

Impact of RBI policy rates on inflation – A critical review

The news item “RBI hikes key policy rates” has become so common that most people do not pay much attention to it. Moreover, the response from RBI has become so predictable that people guess their move before every RBI policy review meeting. Not to be so critical of RBI, there are people with high caliber and knowledge and are working hard to curb inflation and create a robust economy.

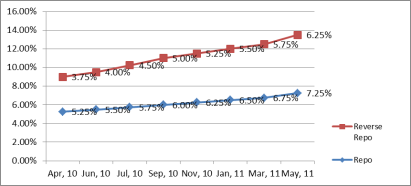

On 2-May-2011, RBI raised the policy rates by 50 basis points taking repo rate to 7.25% and reverse repo to 6.25%. This has impacted the growth as businesses will find it difficult to raise capital. There are further increases in the rates, if experts are to be believed. The Government is fine to sacrifice some growth in order to bring down inflation to a manageable level.

RBI needs to come out of typical response to inflationary pressure and look at the larger picture. It may not have much leverage on the Government’s workings but it can certainly do something more than just raising policy rates to tame inflation.

Policy rates & Inflation

Inflation is general increase in prices of a set of commodities also known as “basket of goods” which are deemed essential for a living. The growth in the prices of these essential items in the basket of goods is inflation.

Government has mainly two policies to influence the economy, namely monetary policy and fiscal policy. Monetary policy focuses on managing supply of money in the system. Supply of money in the system can be controlled by managing the interest rates which is a direct consequence of policy rates (repo and reverse repo). Monetary policy is popular instrument to manage inflation in any economy. This is when we hear news about Government raising policy rates to contain inflation. Sometimes Governments reduce policy rates to fuel economic activity in a slow economy.

How effective has been this instrument in Indian situation

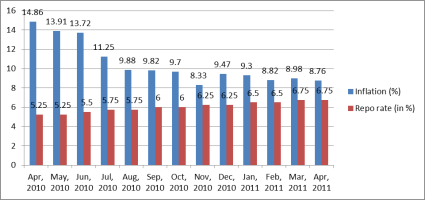

We will take a look at the inflation in India from Apr, 2010 to Apr, 2011. Here is a graph showing the inflation in India.

The inflation was very high in the 2nd quarter of last year but slowly it moderated to a level which is still high and unhealthy for the growth.

Let’s take a look at the policy rates announcements by RBI. RBI has changed policy rates 8 times in last 1 year. The data is as follows:

We can see a humongous increase in policy rates in last 1 year to tame the inflation.

Let’s take a look at the impact of policy rates on inflation.

The impact is not uniform. In the beginning, when the inflation was very high, it came down because of high base effect. However, after Jul, 2010, the inflation rate is fluctuating irrespective of the changes in policy rates. Managing policy rates is a favourite tool for Governments to control inflation. However it didn’t produce the desired results in India.

Why policy rate changes could not impact inflation rate

Increasing policy rates is an effective tool when the inflation is caused by demand side. Demand side inflation is when the demand of goods has increased related to supply of goods. While a growing country like India does see demand going up every year, this alone cannot explain the inflation going up by close to 10%.

The major reason for inflation is getting more money in the market. The Governments contributes heavily to this problem by printing money to fund the deficit, to pay extra salaries, and to provide subsidy. Unless the Government looks at its own revenue and expenditure gap and reduces to a manageable level, inflation will remain a concern.

The other significant problem lies in supply side. India doesn’t have enough storage capacity to store grains and agriculture produce. A huge amount of food grains are left in the open to rot and finally turn unusable for human consumption. This creates an artificial gap between the demand and supply of food grains.

Additionally, inefficiency in basic industries and lack of infrastructure create their own bottleneck causing price rise of commodities. It is not difficult to understand that transporting goods from railways is much cheaper than by roadways. We have dearth of capacity in railways. The result is we transport major goods by trucks which run on bad roads which further increases cost in the form of fuel.

Today itself, we read in newspaper that states are not taking grains that are sent by central Government. They are kept unattended. How, in such a scenario, RBI’s policy rates hikes are going to help.

What other steps RBI, along with the Government, can come up with

Increasing policy rate is just one of the steps in curbing inflation. Unless we take care of other bottlenecks in the economy, it will not go away. The Government should focus more on building infrastructure, putting a lid on deficit, and improving the supply side economics to build a comprehensive strategy to tame it. Otherwise, changing policy rates will not do much to tame inflation. Moreover, there is limit to policy rates. It is already unhealthy at 7.25%.

Undoubtedly, in a globalized world, central banks and Governments do not have full control over their economy. For example, rise in oil prices, futures trading, and inclement weather are some of the events on which central banks and Government have no control. However, this should not stop the Government and central banks to push for the structure reform in the economy. This one step will do more to tame inflation than changing policy rates in every 2-3 months.