What’s

US debt crisis in a layman’s language?

Everyone

is talking about this new financial crisis. Stock markets all over the world

are plunging in response to the US debt crisis. In our country too, the

sensex is on a downward path since the time the news about this crisis

broke. Share values of Indian IT companies whose revenues are heavily

dependent on the US economy are falling steeply in the response.

What

exactly is this US debt crisis?

Why does a country borrow?

When a

country spends more than it earns through revenues, it has to borrow money

from the global market to meet the expenditure. The country also needs to pay

back the debt in installments over a period of time. This is called as debt

obligations. So once a country borrows, the expenditure of the country shoots

up. Hence the next time the country has to borrow more to meet not just the

expenditure but also the debt obligations. From this you can understand that

the countries’ debt amount goes on increasing with time as they borrow more

and more. United States is no different and is also under a huge debt of

$14.3 trillion at present. In fact, lending money to US is considered as a

safe and promising investment.

It is very

common for a country to spend more than its revenues. So it is

also normal for a country to borrow. In 2011 federal budget, the US

government estimated the expenditure at $3.82 trillion and revenues at

something more than $2 trillion. That implies a deficit of around $1.5 trillion.

Under normal situation, US govt. would have borrowed and compensated this

deficit. But they couldn’t because of the debt ceiling that is set by the US

Congress.

What is debt ceiling?

Debt

ceiling is a cap set by the US Congress on the amount of debt the government

can borrow. The limit was first set in 1917 at $11.5 billion. Whenever

the govt. reaches the ceiling, it can’t borrow more. Every time the cap is

reached the Congress approves a higher debt ceiling and directs the treasury

to borrow more. To raise the cap, a legislation has to be passed in both the

houses of the Congress: the Senate and the House of Representatives. The cap

was last raised to $14.3 trillion which the current govt. reached in May this

year. Since then the US is not being able to borrow more debt.

Why is the debt ceiling so

important?

The US government

has a legal limit on how much debt it can run up – $14.3tn at present. It reached the cap in May, which means

it cannot borrow any more money.

Wasn’t There a Commission About This in the US history?

Yes .That would be the bipartisan National Commission on Fiscal

Responsibility and Reform. Bye-Partisan. They proposed a six-part plan to put US on a path to fiscal

health, promote economic growth, and protect the most vulnerable among us.

But it the recommendations were not implemented…!

What would hav Happened If ‘US’ Default?

(from US point of view)

First,

if the deadline is not met, the country would likely enter a super serious

recession which would cause super bad chaos in the global economy. Bad things

would happen. Gloom would prevail. Goth bands would be taken seriously.

Second,

Experian, Equifax, and TransUnion would reduce the country’s credit ratings

from the 900s down to the 300s. The country couldn’t get a credit card, buy a

used car, or pay for hookers. Things would be grim. End times.

Third,

it would cost more for the government to borrow money. Higher interest rates

for mortgages, loans, and credit card balances. People will sell their gold

fillings, relatives, and body organs. Many Americans would move to Canada.

Fourth,

the country’s economic reputation would take a major hit in the markets,

creditors would demand higher interest rates, and investors would drop their

holdings in US dollars. The country would be renamed North Mexico.

How Does

This Affect a US citizen?

If your US Government defaults, it may

not be able to pay Social Security and Medicare benefits, military salaries,

interest on the national debt, tax refunds, or Groupons.

Why did not the US Congress raise the ceiling again and borrow?

This

is where the politics has come into the play. Raising the debt ceiling would

have been the obvious step as it has happened several times in the past: both

under the Democrats and the Republicans. But this time around the Republicans

(who are in opposition now) raised reservations over increasing the ceiling.

They did not agree to raise the ceiling unless huge spending cuts

without tax increase were agreed on. The Tea Party movement that started

in 2009 with a focus on reducing government spending and regulation

helped the republicans to win a substantial number of seats in the 2010

midterm elections. The Republicans fought the election on the planks

of cutting federal spending and stopping tax increases. Sticking to

those lines, they refused to support raising the debt ceiling unless

their demands were met. Since the Republicans control the House of

Representatives, the raising of debt ceiling could not be approved by the

house of Representative without their consent. President Obama and his

party is in minority in the house. So there was no other way left for the

Obama administration and they had to reach a settlement with the opposition

as quickly as possible.

What happened then? Did the two parties agreed on some settlement?

As

the US had already reached the debt ceiling in May, they needed to tackle the

issue immediately. It was apprehended that after August 2nd if the US govt.

couldn’t borrow, then US Treasury Department would have run out of money to

pay its bills. That could have resulted in widespread panic all over the

world because a large number of people and organisations receive payments

from the US.

At

the end, both sides agreed to control the deficit without raising taxes and

by spending cuts.

The House of

Representatives approved legislation to raise the U.S. debt limit by at

least $2.1 trillion and cut federal spending by $2.4 trillion or more.

So a catastrophic event was averted?

What is the outcome?

Yes, the result could

have been catastrophic if the cap wouldn’t have been raised. But the market

all over the world has reacted nervously and are worried over the US handling

of the debt problem. In an interesting development, USA lost its AAA

credit rating to AA+. In common language that means now lending money to US

is not safe (AAA rating means safe) and little risky. That also means the

interest rates will increase slightly making it difficult for the US to raise

money through debt. The current agitation in the financial markets are in

reaction to this developments.

Why will the crisis

don’t Impact much on India ?

·

India’s growth story is intact and

its fundamentals are strong.

·

We are in a better position than

many other nations to manage this challenge.

·

There could be some impact on the

capital and trade flows in the country.

·

We could notice FIIs seeing India

as an attractive investment destination even if there is any temporary

outflow since our fundamentals are strong.

·

We could rather see faster and

greater FII inflows, unlike after 2008,

in view of the higher returns that global investors could get in

India.

·

Softening of the international

commodity prices, especially fuel oil will help check inflationary pressures

in the economy.

RBI on the entire situation

The RBI has said the country has sufficient

liquidity to manage a possible US sovereign debt default. The RBI is prepared

for any repercussions in the financial markets arising from any such

eventuality. The RBI has said the country has sufficient

liquidity to manage a possible US sovereign debt default. The RBI is prepared

for any repercussions in the financial markets arising from any such

eventuality.

What is Standard & Poor's (S&P)?

It is a

United States–based financial-services company. It is a division of the McGraw-Hill Companies that publishes financial research and

analysis on stocks andbonds. It is well known for its stock-market indices, the US-based S&;P 500, the Australian S&;P/ASX

200, the Canadian S&;P/TSX, the Italian S&P/MIB and India's S&P CNX Nifty. The company is one

of the Big Three credit-rating agencies, which also

includes Moody's Investor Service and Fitch Ratings.

What are

Mortgages?

A

mortgage is a loan, commonly from a bank or a government-backed entity, that is

used to purchase a property. It can also be used to refinance a specific

mortgage or to cash out accrued equity on a property. A mortgage is a secured

loan as it takes the property for which it was issued as collateral.

America has had its credit outlook revised to negative

from stable by Standard & Poor’s Ratings Services.

(India’s

credit rating is ‘BBB minus’.)

But what

are credit rating agencies and how do ratings work?

What is a credit rating?

A credit rating is an opinion of

the general creditworthiness of individuals, companies and countries. Lower

credit ratings result in higher borrowing costs because the borrower is

deemed to carry a higher risk of default. A downgrade for America would mean

US bond investors would want to get paid more to compensate for the risk of

holding government debt.

What are sovereign credit ratings?

Sovereign credit ratings measure

the risk of investing in countries – political as well as economic risk. For

instance in Monday's statement S&P has pointed to the deficit as a risk

for investors in the US because Democrat and Republican policymakers have

still not agreed on a way to tackle it.

What is the role of credit rating

agencies?

Credit

rating agencies assess the risk of investing in corporations and governments.

The largest are Moody's, Standard and Poor's and Fitch Ratings. They also

provide a wide array of financial data and information on bonds, equities and

mutual funds.

How do they make money?

Agencies typically receive payment

for their services either from the borrower that requests the rating or from

subscribers who receive the published ratings and related credit reports.

How much weight does a rating

carry?

A lot of investment, such as

corporate and government bonds, must carry a credit rating. This has resulted

in credit rating agencies becoming very influential. However, their role in

the sub-prime crisis, when they rated various mortgage-backed financial

instruments that have subsequently been branded "toxic", has damaged

their reputation.

What do Standard and Poor's

"letter" ratings mean?

·

AAA -

Extremely strong capacity to meet financial commitments. Highest rating

·

AA - Very

strong capacity to meet financial commitments

·

A - Strong

capacity to meet financial commitments, but somewhat susceptible to adverse

economic conditions and changes in circumstances

·

BBB - Adequate

capacity to meet financial commitments, but more subject to adverse economic

conditions

·

BBB- (minus) -

this is the lowest rating before non-investment grade

·

BB: Less

vulnerable in the near-term but faces major ongoing uncertainties to adverse

business, financial and economic conditions

·

B: More

vulnerable to adverse business, financial to meet financial commitments

·

CCC: Currently

vulnerable and dependent on meet financial commitments

·

CC: Currently

highly vulnerable

·

C: A

bankruptcy petition has been filed or similar continued

·

D: Payment

default on financial commitments

Ratings in the 'AAA,' 'AA,' 'A' and

'BBB' categories are regarded by the market as investment grade.

Ratings in the 'BB,' 'B,' 'CCC,'

'CC' and 'C' categories are regarded as having significant speculative

characteristics.

Ratings from 'AA' to 'CCC' may be

modified by the addition of a plus (+) or minus (-) sign to show relative

standing within the major rating categories.

NR indicates that no rating had

been requested, there is insufficient information on which to base a rating,

or that S&P does not rate a particular obligation as a matter of policy.

What

is an outlook definition?

An S&P rating outlook assesses

the potential direction in which a rating will move over the next six months

to two years.

·

Positive - may be

raised.

·

Negative - may be

lowered.

·

Stable - unlikely

to change.

·

Developing - may be

raised or lowered.

·

NM - not

meaningful.

Lowering an outlook is generally

considered to be the first step towards a downgrade. S&P said: "Our

negative outlook on our rating on the US sovereign signals that we believe

there is at least a one-in-three likelihood that we could lower our long-term

rating on the US within two years."

S&P’s Downgrade of US Debt - 5

Reasons Why it is Wrong and Markets will Rebound

1)

Political Motivations

2) Poor Arithmetic or Malicious Intent

3) S&P’s Business Model

4) S&P’s Professional Incompetence

5) A Recent History of Defrauding

Investors

The first week of August, 2011 saw the world financial markets tumbling like a house of cards, the trigger

being the US debt downgrade by credit ratings agency Standard & Poor's. Stock markets across the globe

witnessed heavy panic selling between 1st and the 8th of August, 2011. The

biggest losers were the markets of Brazil and the USA, both losing 16.9% and

13% respectively. However, stock markets in India and China were relatively resilient

and declined by 8.1% and 6.6% respectively.

|

Chronology of events which need to

be taken into consideration for understanding the US debt crisis.

How the debt talks spiraled into crisis

November 2, 2010

Republicans win control of the House of Representatives on a

promise to scale back government spending and tackle budget deficits that

have hovered at their highest levels relative to the economy since the Second

World War.

December 1, 2010

A report by a bipartisan deficit-reduction panel commissioned

by US President Barack Obama advocates $3 trillion in spending cuts and $1

trillion in revenue increases - mainly by closing loopholes in the tax code -

over 10 years.

January 2011

Six Republican and Democratic senators, known as the

"Gang of Six", begin talks on a long-term deficit-reduction deal

they can present to their parties.

February 19

The House passes a budget for the current fiscal year that

would cut $61bon from last year's levels. The Democratic-controlled Senate

defeats it one month later.

April 9

Obama and congressional leaders bring the government to the

brink of a shutdown before they agree on a budget for the current fiscal year

that cuts $38bn from last year's levels. Billed as the largest domestic

spending cut in US history, it actually causes the government to spend $3.2bn

more in the short term.

April 13

After Obama's initial proposal is criticised as inadequate,

the President lays out a new deficit-reduction plan that would save $4

trillion over 12 years. He proposes that Vice-President Joe Biden lead

deficit-reduction talks.

April 15

The House passes a budget that would cut spending by $6

trillion over 10 years, in part by scaling back healthcare for the elderly

and the poor.

May 5

Biden and negotiators from both parties hold their first

meeting as top Republicans say there will likely be no broad agreement on tax

reform and healthcare.

May 9

House Speaker John Boehner, the top Republican in Congress,

says any increase in the debt ceiling must be matched by an equal amount of

spending cuts. The Treasury Department estimates it needs at least $2

trillion to cover borrowing through the November 2012 elections.

May 11

House Republicans release a spending outline for the coming

fiscal year that has its deepest cuts in education, labour and health

programs cherished by Democrats.

|

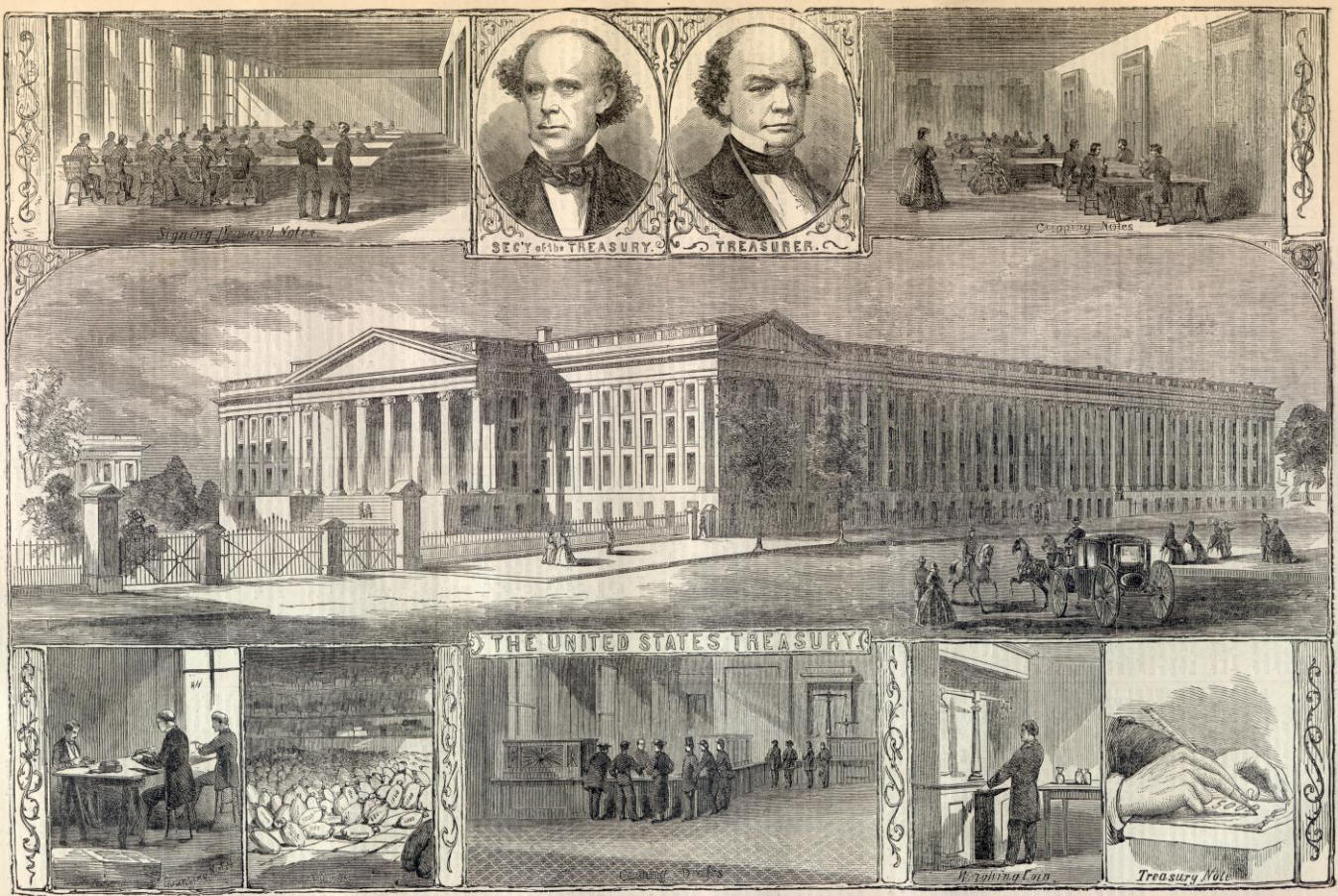

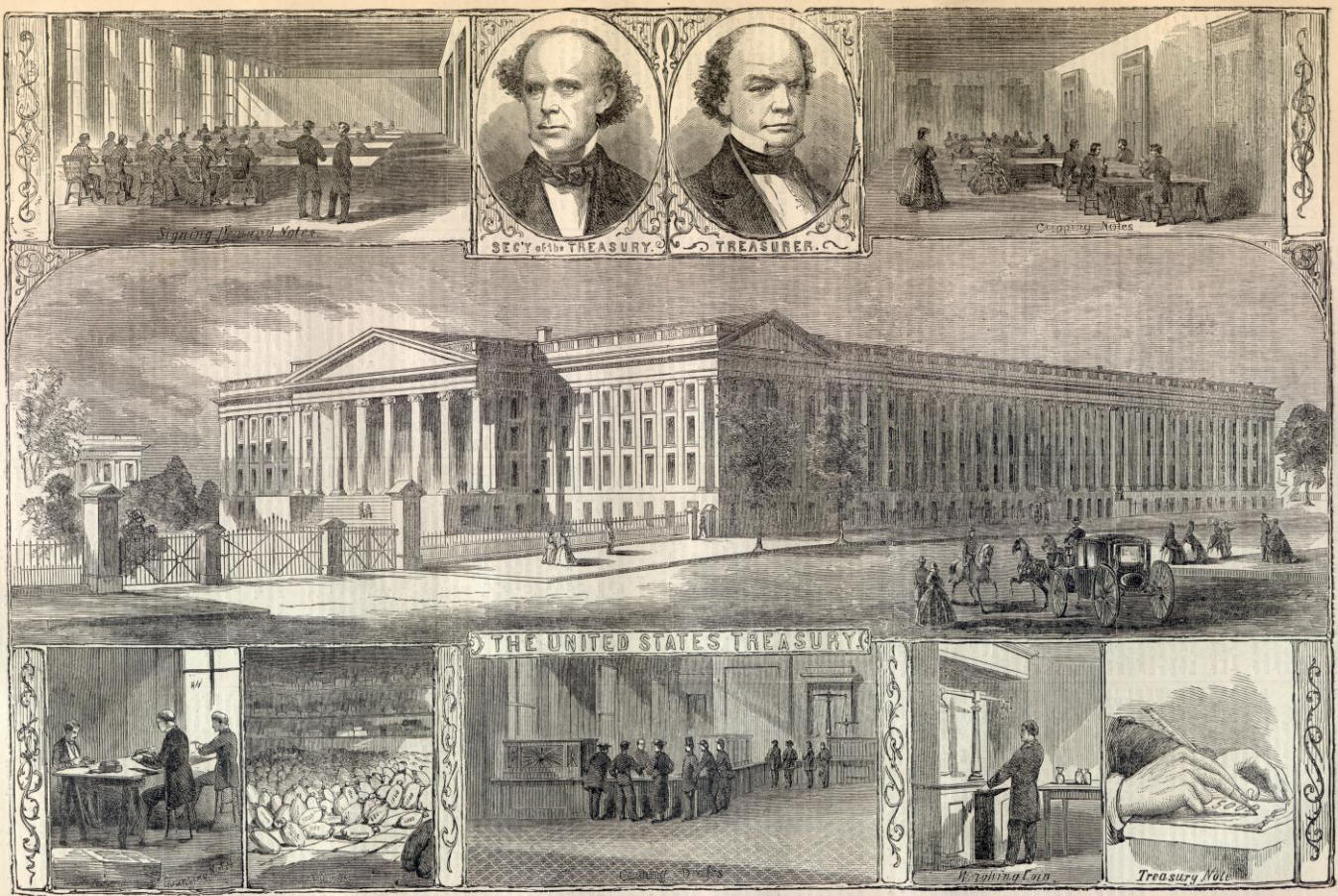

| US Treasury building |

May 16

The US reaches its $14.3 trillion debt limit. The Treasury

Department begins tapping other sources of money to cover the government's

bills.

May 17

The "Gang of Six" talks falter as a leading

conservative, Republican Senator Tom Coburn, drops out due to an impasse over

healthcare.

May 31

The House of Representatives rejects a measure to raise the

debt limit in a vote staged by Republicans to pressure Obama to agree to

accompanying spending cuts. Senior Democrats decry the vote as a political

stunt, although 82 Democratic lawmakers join Republicans in defeating the

bill.

June 9

In a sixth meeting of the Biden group, Treasury Secretary

Timothy Geithner argues that tax increases need to be part of the equation,

but Republicans remain unmoved.

June 14

Some 34 Senate Republicans vote to repeal tax breaks for

ethanol, a sign that there may be some wiggle room in the party's

no-tax-increase stance.

June 23

Republicans declare an impasse in the Biden talks, saying that

Democrats are insisting on roughly $400bn in new revenue by closing tax

breaks for the wealthy and certain business sectors.

June 29

The International Monetary Fund says the US must lift its debt

limit soon to avoid a "severe shock" to global markets and a

still-fragile economic recovery. Obama calls for new steps to spur job growth

and tax hikes on the rich, irking Republicans who remain focused on deficit

cuts.

June 30

Democratic legislators discuss a scaled-back deal that would

avert default but force Congress to tackle the debt ceiling issue again

before the 2012 elections. The White House rejects the idea.

July 3

Obama and Boehner meet secretly to discuss a more ambitious

"grand bargain" that would save roughly $4 trillion over 10 years

through an overhaul of the tax code and changes to popular benefit programs.

July 5

Obama invites top lawmakers to the White House to restart

negotiations and clinch a deal by July 22.

July 6

Reuters reports that a small team of US Treasury officials are

looking at options to stave off default should Congress fail to raise the

limit. The Obama administration continues to say there is no contingency plan

in place.

July 7

After hosting lawmakers at White House, Obama says Republicans

and Democrats are still far apart on many issues but that all agree on the

need to raise the debt ceiling.

July 8

A dismal jobs report focuses new attention on the sputtering

economy. Obama says uncertainty about the debt ceiling talks is hurting

economic expansion.

July 9

Boehner says a "grand bargain" is out of reach

because Republicans will not accept the tax increases Democrats are

demanding, and he calls for a more modest $2 trillion package that would rely

mostly on spending cuts.

July 10

During a testy, brief meeting at the White House, Obama and

congressional leaders agree on little more than the need to meet again the

following day.

July 11

The follow-up meeting breaks little new ground, but Obama

pressures both Democrats and Republicans to make concessions that would clear

the way for a deal. Another meeting is planned for July 12.

July 12

Senate Republican leader Mitch McConnell offers backup plan for

raising the debt limit if there is no agreement on a broad deficit-reduction

plan. Obama warns that if the debt-limit impasse is not resolved soon,

government benefits for older Americans might be at risk after August 2.

July 13

Moody's Investors Service puts US on review for possible

downgrade given possibility that debt limit won't be raised in time. Obama

meets lawmakers for nearly two hours but a deal remains elusive.

July 14

Ratings agency Standard & Poor's says there is a

one-in-two chance it could cut the US's top-notch AAA credit rating if talks

remain stalemated. Obama suspends debt talks and gives party leaders 24 to 36

hours to deliver deadlock-breaking "plan of action".

July 17

McConnell and Senate Democratic leader Harry Reid work on

McConnell's fallback plan to allow Obama to raise the debt limit. Obama meets

Boehner and his deputy, Eric Cantor, secretly at White House but no progress

is made toward a deal.

July 18

Republicans push for a measure that would cut and cap

government spending and require an amendment to the US Constitution requiring

a balanced budget. Obama says he will veto it should Congress send it to his

desk.

July 19

The "Gang of Six" resurfaces with a deficit

reduction plan that proposes $3.75 trillion in savings over 10 years and

contains $1.2 trillion in new revenues. Obama seizes on it and calls on

leaders in Congress to start "talking turkey". House Republicans pass

a more drastic $5.8 trillion deficit-reduction plan with a balanced budget

amendment.

July 20

The White House signals Obama may be willing to accept a very

short-term debt limit extension beyond August 2 to give any agreed

deficit-cutting bill time to clear Congress. The President holds separate

meetings with top Democratic and Republican lawmakers.

July 21

Obama and Boehner are reported to be discussing a $3 trillion

deficit-cutting deal. Obama stresses some revenues will need to be included

in any accord. Obama meets with congressional Democratic leaders at the White

House, but there are no reports of a breakthrough.

§ July 22, 2011. The

Senate votes along party lines to table the Cut, Cap and

Balance Act; 51 Democrats voting to table it and 46 Republicans voting to

bring it to a debate. Senate Majority Leader Harry Reid called the

Act "one of the worst pieces of legislation to ever be placed on the

floor of the United States Senate." Even had it passed Congress, Obama

had promised to veto the bill.

§ July 25, 2011.

Republicans and Democrats outlined separate deficit-reduction proposals.

§ July 25, 2011.

Obama and Speaker of the House John Boehner addressed the

nation separately over network television with regards to the debt ceiling.

§ July 25, 2011. The

bond market is shaken by a single $850 million futures trade betting on

US default.

§ July 29, 2011. The Budget Control

Act of 2011 S. 627 ,a Republican bill that

immediately raises the debt ceiling by $900 billion and reduces spending

by $917 billion, passes in the House on vote 218–210. No Democrats voted

for it and it also drew 'no' votes from 22 Republicans who deemed it

insufficiently tough on spending cuts. It allows the President to

request a second increase in the debt ceiling of up to $1.6 trillion

upon passage of the balanced-budget amendment and a separate

$1.8 trillion deficit reduction package, to be written by a new

"joint committee of Congress."Upon introduction into the Senate in

the evening, the bill was immediately tabled on a 59–41 vote including some

Republican votes.

§ July 30, 2011. The

House of Representatives voted 173–246 to defeat Senate Majority Leader Harry

Reid's $2.4 trillion plan to reduce the deficit and raise the debt

ceiling.

§ July 31, 2011.

President Barack Obama announces that leaders of both parties have reached an

agreement to lift the debt ceiling and reduce the federal deficit, and

separately, House Speaker John Boehner told

Republicans that they have reached the framework for an agreement.Boehner

reveals details of the agreement in a presentation to the House Republicans.

§ August 1, 2011. The

House passes a bipartisan bill by a vote of 269–161. 174 Republicans and 95

Democrats voted 'yes'; 66 Republicans and 95 Democrats voted 'no'.

§ August 2, 2011.

The

Senate passes the bill by a vote of 74–26. 28 Republicans, 45 Democrats, and

1 independent voted 'yes'; 19 Republicans, 6 Democrats, and 1 independent

voted 'no'.President Obama signed the

debt ceiling bill the same day, thus ending fears of a default. Obama

also declared that the bill is an "important first step to ensuring that

as a nation we live within our means."

§ August 2, 2011.

Date estimated by the Department of the Treasury that the borrowing authority

of the U.S. would be exhausted.

§ August 5, 2011. Standard & Poor's lowered the credit rating of the United States from AAA to

AA+,deciding that the budget plan that was passed did not go far enough to

address the country's debt. It also warned that it is pessimistic about the

nation's fiscal outlook.

§ August 9, 2011. The

U.S. Federal Reserve announces it will keep interest

rates at "exceptionally low levels" at least through mid 2013; but,

it also makes no commitment for further quantitative

easing.The Dow Jones Industrial Average and the New York Stock

Exchange as well as other world stock markets, recover after recent

falls. (Wall Street Journal)

Projected:

§ August 15, 2011.

$29 billion of debt interest becomes due. If this is not paid, the

United States technically would be in sovereign default.

|