Budget

aane ko hai...nd they r thinking of introducing this CTT .....sab iska oppose

kar rhe hai..letzz see kyn kr rahe hai ..aur kya hota hai yeah CTT !!!!

What is CTT tax ?

The Basics

CTT is a tax levied on exchange-traded commodity derivatives in India on the

lines of the Securities Transaction Tax or STT — a tax imposed on the purchase

and sale of securities and their derivatives traded on stock exchanges in the

local market.

|

| source - The Hindu |

CTT was proposed in Union Budget 2008-09 but was withdrawn later following the

recommendations of the Prime Minister’s Economic Advisory Council. The

recommendations came after a debate in the media and demands from certain

groups on imposing transaction taxes on commodity derivatives.

Why the Opposition ?

India's five commodity futures exchange houses are strongly against the idea of

a transaction tax on commodity trades similar to that on stock and equity

derivatives trade. According to experts, CTT will sound the death knell for the

organised commodity futures market as the cost of trading will shoot up

eight-folds.

Commodities exchange traders and their fellow mates from the stock markets have

locked horns on whether a Commodity Transaction Tax (CTT), on the lines of the

Securities Transaction Tax (STT), is desirable or not.

Stock market operators, brokers and officials want the STT withdrawn as they

feel it is an unfair levy.

Is CTT necessary?

Straight answer, no! It is a fact that the transaction tax is not an equitable

tax.

By its very nature, tax should be collected only on profits or gains from

business activity. However, transaction tax is imposed on the transaction value

irrespective of whether such deal ends up in profit or loss.

For example, if you sell a share in the stock market and incur a loss, you

still have to part with a portion of the proceeds of the sale to the

government, which is not desirable by many a traders and institutions alike.

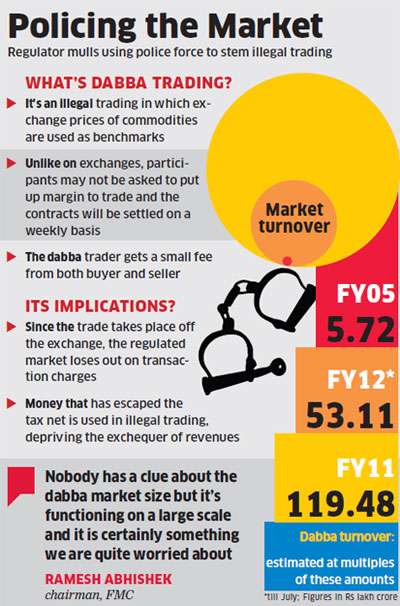

Industry representatives have also warned that any transaction tax on commodity

derivatives will shift the declining business to either illegal 'dabba' trading

or overseas commodity exchanges.

"Imposition of Transaction Tax on commodity derivatives transactions will

boost the illegal 'dabba trading' markets without any gain to the

exchequer," said the commodity exchanges in their representation to the

government.

"The government considered the advice of PMEAC, as it concerns lakhs of

jobs and livelihood in the entire commodities market ecosystem and took a

considered view", they said, adding it would be retrograde to impose it at

a time when the commodities market is struggling to arrest decline in trading

volume.

Rejecting the contention that securities transaction tax (STT) was shifting

trade to commodity exchanges, they said, while equity trade provides for

capital appreciation, commodity exchanges help stakeholders to hedge risk

against adverse price movements. Both cannot be compared, they added.

With such ‘crowding out’ of short-term volumes, there can be losses in incomes and concomitant tax collections, which might even outweigh the expected revenues from CTT.

Again, such reduction in market liquidity will increase the bid-ask spread, a major component of transaction costs.

=================================================================================

Some Questions which must b answered ?

Two issues arise.

The first is what

about farm products? Should they be taxed?

Today, vibrant trade takes place in the oil complex and to a

limited extent in chana and some spices. The trading community is well dispersed across traders, brokers,

corporates, etc. There is also a suspicion about the role played by speculators in pushing

up prices in the case of pulses and cereals earlier that prompted bans and the

magnification of prices when there are shortages in narrow

commodities such as spices. We have had an expert committee that looked into

the linkage between futures trading and spot prices which did find any such

relation.

But, this raises an interesting question. If futures trading does

not influence spot prices, then what exactly do we mean by price discovery?

Therefore, there is an inherent contradiction in such logic because if prices

are discovered and efficient, then they should logically impact spot prices.

And if they do not, then what could be the purpose of such prices? One may

recollect that the main reason from bringing back

futures trading was to enable benefits to go to farmers through better prices. Therefore, the basis of futures trading hangs precariously when

this rationale has to be balanced with causes for inflation and the quality of

trading.

The second is what

happens to hedgers in this market?

Farmers do not trade,

because they have little access. The non-passage of the FCRA means that their

participation remains a part of the wish-list of FMC, which has little power to

change the rules of the game. Further, there are hedgers such as jewellers and

corporates who deal with steel, aluminum, edible oils, etc. Such a tax puts a

burden on them. The solution is really to have exemptions for hedgers who

already have separate hedge limits with the exchanges as per the rules laid

down by the FMC. Therefore, they should get refunds or exemptions. The UID Aadhaar scheme should help

to keep farmers out of the ambit of such a tax as and when they come in.

=================================================================================

Why is Government is Desperate to bring

it ?

- The first is that the government requires money, and any amount is welcome as the effort is to look at all options.

- The second is that if the stock markets are subject to the securities transaction tax (STT), why not the commodity market?

- The third is that the market is now mature, or has reached whatever level of maturity that is possible given the constraints of absence of movement in policy, and is almost a decade old. In fact, as a corollary, once done, the government can also start looking at the forex derivative market.

Moral of the Story

The CTT issue is contentious and there are an equal number of examples of success

and failure of such taxes in markets, be it securities or commodities. The same holds

for countries with and without such taxes. But the reality is that the government is

trying to tap all possible sources of taxation and this market looks juicy enough—

especially the non-farm segment. The fact that there is a lot of concern on gold

imports could be a factor hastening the introduction of this tax. Hence, while the

market would be better off in case CTT is held back for some more time, it may be

inevitable.

========================================================================

Addititional Reading !!!

What is a FUTURES MARKET/

WAYDA BAZAAR ?

An auction market in which participants buy and sell commodity/future contracts for delivery on a specified future date. Trading is carried on through open yelling and hand signals in a trading pit.

When you make an agreement with someone that you’ll buy gold/potato or anything in x quantity at y price on z date in future. This is future contract.

Waydaa Bazaar is the place where brokers hang out to make and trade such future and options* contracts.

*Options means, with such agreement, you’ve the right to buy that 1000 kg potato at the pre-determined price Rs.150,000 in future, but not the obligation to buy it.

Means you can refuse to buy it later on, if you’re not in mood or find someone who is selling the same thing at lower prices! But in that case you loose the premium money paid on that options contract.

---------------------------------------------------------------------------------------------

What is FMC and FCRA ?

FMC stands for Forwards Market Commission ....it functions exactly the same way in commodity markets (forwards market ) as SEBI functions in case of Securities market i.e. Regulating. (but does not have strong powers like SEBI as )

FCRA stands for Future Contracts Regulation Act which is yet to b passed in Parliament ..empowers with greater powers to the FMC !!

--------------------------------------------------------------------------------------------

What is

Dabba

trading ?

Dabba means box and a dabba operator, in stock market terminology is the one who indulges in dabba trading. His office is like any other broker’s office having terminals linked to the stock exchange showing market rates of stocks. However, the difference is that the investor’s trades do not get executed on the stock exchange system but in the dabba operator’s books only. A dabba operator acts as a principal to all the trades and not as an agent of the client. He is a counter party to the trades, whereas, he should be the Clearing Corporation who guarantees trades on the BOLT/NEAT system. This kind of operation, where trade is kept within the books of the operator is called “dabba” in the popular market terms.

-------------------------------------------

What is Crowding Out and Crowding

In effect ?

Crowding Out

An economic concept where increased public sector spending replaces, or drives down, private sector spending.

For example, the higher taxes required for government to fund social welfare programs leaves less discretionary income for individuals and businesses to make charitable donations. Further, when government funds certain activities there is little incentive for businesses and individuals to spend on those same things. Another example is increased government spending on Medicaid, which has been linked to decreased availability of private health insurance.

Crowding In

An economic principle in which private investment increases as debt-financed government spending increases. This is caused by government spending boosting the demand for goods, which in turn increases private demand for new output sources, such as factories. This is in contrast to crowding out

---------------------------------------------------------------------------------------------

Who is a Hedger , Speculator and

Arbitrageur ?

Hedgers :

They are generally the commercial producers and consumers of the traded commodities. They participate in the market to manage their spot market price risk. Commodity prices are volatile and their participation in the futures market allows them to hedge or protect themselves against the risk of losses from fluctuating prices. For e.g. a copper smelter will hedge by selling copper futures, since it is exposed to the risk of falling copper prices.

Speculators :

They are traders who speculate on the direction of the futures prices with the intention of making money. Thus, for the speculators, trading in commodity futures is an investment option. Most Speculators do not prefer to make or accept deliveries of the actual commodities; rather they liquidate their positions before the expiry date of the contract.

Arbitrageurs :

They are traders who buy and sell to make money on price differentials across different markets. Arbitrage involves simultaneous sale and purchase of the same commodities in different markets. Arbitrage keeps the prices in different markets in line with each other. Usually such transactions are risk free.