Recently, Prime Minister Narendra Modi launched the Pradhan Mantri Jan Dhan Yojana

(PMJDY), one of the world’s most ambitious initiatives to promote financial

inclusion. The programme is off to a good start—within six months, nearly 125

million new bank accounts have been opened.

The Pradhan Mantri Jan Dhan Yojana programme, the

drive launched by Prime Minister Narendra Modi to ensure at least one member in

every household in the country had a bank account, could soon emerge as a

worldwide template for achieving rapid financial inclusion.

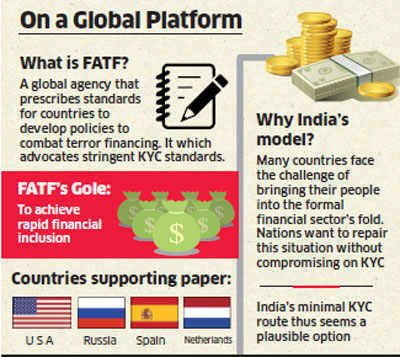

The Financial Action Task Force, a global

anti-terror financing agency, has given initial approval to a paper by India on

how it achieved the task in a few months while adhering to know your customer

(KYC) norms. The study will now be fleshed out further. The agency, which

advocates stringent KYC standards in order to stamp out terror financing, is

keen to see whether the Indian model can be emulated by other countries. The

US, Russia, Spain and the Netherlands have extended support to the paper.

|

Since Independence, India has pursued a range of initiatives to

wean the poor away from traditional forms of moneylending and bring them into

the financial mainstream. Now, financial inclusion has become a prominent

policy priority.

The programme builds on the country’s recent successes. While

earlier efforts to expand financial inclusion may have fallen short of

policymakers’ hopes, the more recent growth of group lending models and

microfinance institutions has made it easier for the rural poor to save and

take loans. Moreover, business correspondent models have helped expand the

reach of financial access points, microfinance institutions have been brought

under a self-regulatory mechanism, the national payments system has been

developed and strengthened, and the Unique Identification Number (Aadhaar)

initiative has been rapidly scaled-up, signing on new customers and

authenticating them to make transactions more efficient. The recent

establishment of small banks and payment banks is also a clear step forward.

Nonetheless, significant potential exists to further leverage

technology to boost financial inclusion.

Already, direct cash transfers into beneficiaries’ Aadhaar-linked

bank accounts are starting to plug leaks and promoting the cost-effectiveness of

social benefit schemes.

THE WAY FORWARD !!!

- Expanding the use of Aadhaar

to banks, insurers, post offices,

non-banking financial companies, microfinance institutions, cooperatives

and mutual funds can boost these efforts considerably.

- The rich dataset of transactions that

such expansion will yield can help develop new financial products

for households and small businesses. For example, data

on individual patterns of saving or timely repayment records in a credit

bureau can substitute the requirement for collateral assets or guarantees,

making it easier for institutions to offer loans, insurance or

micro-investment products to underserved segments of society. Traditional

channels such as cooperative banks, post offices and rural financial

institutions too can play a greater role.

- India can also take advantage of the developments in mobile telephony. With more than 870 million active mobile subscribers, India can expand financial inclusion by promoting mobile financial services. For instance, mobile money can help eliminate ad hoc means of transferring money that are expensive, unreliable and prone to theft. It can complement the 425 million debit and credit cards currently in use in India and target the 150 million RuPay cards linked to PMJDY accounts, of which 110 million have already been issued. For these models to work, however, they must ensure commercial viability for the banks, banking correspondents and others providing needed services.

|

- Ensuring women’s

access to resources is equally critical. Although

microfinance has successfully linked many women to mainstream financial

services, most women-owned micro, small and medium enterprises (MSMEs)

continue to remain underserved by formal institutions—only about 3%

of the country’s 3 million such enterprises have formal financial access.

|

- A robust system is also needed to ensure consumer protection and build depositors’ trust in and understanding of the system. While efforts are on to continue to expand financial services, the suitability of the products on offer and the financial capability of clients are also being emphasized, helping create confidence among new customers that their money is safe.

- Globally, the goal is to

achieve financial access for all by 2020. World Bank Group

president Jim Yong Kim and Queen Máxima of the Netherlands—the

UN secretary-general’s special advocate for inclusive finance for

development—have urged countries to make a concerted effort in this

regard.

|

- The success of PMJDY can indeed be a model for other countries. India is already providing leadership and spurring innovations. Recently at the World Bank’s headquarters in Washington DC, Reserve Bank of India governor Raghuram Rajan and State Bank of India chairperson Arundhati Bhattacharya shared their insights on India’s successes, the priorities that lie ahead and the challenges that remain.

- On its part, India too can

benefit from the wealth of experience garnered by other countries in

promoting financial inclusion. Being home to one-third of the world’s poor

living on less than $1.25 a day, India’s success will be key if we are to

achieve universal financial access by 2020.