The Constitution does not provide for a parallel levy of indirect

taxes by the Centre and states, a pre-requisite for the roll-out of goods and

services tax (GST) in the country. The government introduced in Parliament last

week the 122nd Constitution amendment Bill to address this.

Some key highlights of the Bill are:

1.Enables introduction of GST

1.Enables introduction of GST

- The

Bill replaces the lapsed 115th Constitution amendment Bill, introduced by

the United Progressive Alliance (UPA) government in March 2011.

- This

enables the Centre and state governments, including Union territories, to

introduce the law for levying GST on supply of goods and services.

- Under

the GST regime, there will be one Central GST law and one state GST law

each for the states.

2.'GST' defined

- The

term 'GST' is defined in Article 366 (12A) to mean "any tax on supply

of goods or services or both except taxes on supply of the alcoholic

liquor for human consumption".

- Thus,

all supply of goods or services will attract Central GST (CGST) and state

GST (SGST), unless kept out of purview of GST. In effect, works contracts

will also attract GST. As GST will be applicable on 'supply', the

erstwhile taxable events such as 'manufacture', 'sale', 'provision of

services', etc., will lose their relevance.

- As

the term 'supply' is not defined or elaborated or qualified such as, supply

for a consideration etc, it needs to be seen whether even free supply will

attract GST.

3. 'Service' defined

- The

115th Constitution amendment Bill did not provide for a definition of the

term 'service'.

- The

latest Bill specifically provides that "services

mean anything other than goods".

- This

broad definition of the term will altogether remove the disputes on the

aspect whether something is goods or services (unless the government

proposes different rates for GST on goods or services or both).

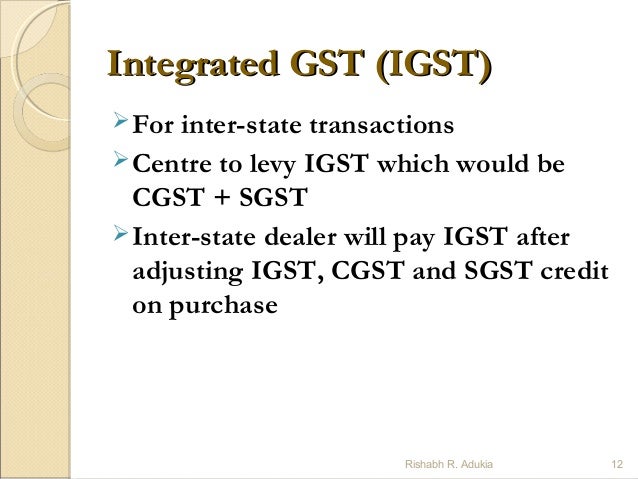

4. Integrated GST

- At

present, inter-state supply of goods attract Central Sales Tax.

- The

Bill provides that an inter-state supply of goods or service will attract

IGST (i.e. CGST plus SGST).

- IGST

will be levied and collected by the Centre, and the proceeds will be

shared among the Centre and the states.

|

5.Inter-state sale of goods to attract additional tax

- The

Bill provides that an additional tax up to 1 per cent will be levied by the Centre on

inter-state supply of goods (and not on services).

- This

additional tax, applicable for a period of two years, will be assigned to

states from where the supply of goods originates.

- The

GST Council could further extend the period beyond two years.

- However,

the Bill is silent on whether credit of this additional levy will be

available, or will it be a cost in the supply chain. In case of latter, it

could have a tax cascading effect on the supply chain.

6.Import of goods or services

- At

present, import of goods attracts basic

customs duty (BCD), additional customs duty (ACD), and special additional

customs duty (SAD), while import of a service attracts service tax (or research and

development cess in few instances).

- The

Bill provides that the import of goods

or services will be deemed as supply of goods or services or

both, in the course of inter-state trade or commerce and thus it will

attract IGST (CGST plus SGST). Thus,

import of goods will attract BCD and IGST, while import of services will

attract IGST.

7. Alcohol for human consumption

|

- It

appears that alcohol for human consumption will be kept outside the GST

regime.

- Exclusion

of the alcohol sector could mean that companies manufacturing alcohol may

not be in a position to avail credit of GST paid by them on their

procurements.

8. Petroleum products and tobacco

- Petroleum

products and tobacco will continue to attract excise duty.

- However,

the Bill specifically provides that petroleum products might not attract

GST.

- However, at a later stage the GST Council might decide

to levy GST on petroleum products.

9. Role of GST Council

The Bill is silent on some key aspects of GST such as :

- · What the model GST law would look like?

- · Which taxes, cesses, surcharges would be subsumed in GST?

- · Which goods and services are subject to, or exempt from GST?

- · What will be the rate of GST, including the floor rates?

- · What will be the threshold limit of GST?

The 115th Constitution amendment Bill provided for a

Dispute Settlement Authority to

settle disputes between states or between states and the Centre with regard to

GST.

=>> However, under the latest Bill, the GST Council has been given

the authority to determine the modalities to resolve disputes arising out of

its recommendations. The GST

Council will consist of the Union finance minister, minister of state and state

finance ministers.

10. Compensation to states

10. Compensation to states

- The Bill did not provide for compensation to

states.

- This Bill specifically provides that Parliament by law,

on recommendation of GST Council, provide for compensation to states for loss of revenue arising out of implementation of

GST up to five years.

By providing for compensation in the Constitution itself, the

Centre seems to have addressed the concerns raised by the states regarding fear

of loss of revenue.

The way forward

The way forward

- After passage through both Houses of Parliament, to

become a law, the Bill will have to be approved by more than half of the

states.

***************************************************************

Insertion of New Articles

1) Article 279A – Goods and Services Tax Council

2) Article 246A – Special Provision with Respect to

Goods and Services Tax

3) Article 269A – Levy and Collection of Goods and

Services Tax in course of Inter-State Trade or Commerce

Amendment to Existing Articles

1) Article 248- Residuary powers of legislation

2) Article 249- Power of Parliament to Legislate with

respect to a matter in the State List in the National Interest

3) Article 250- Power of Parliament to Legislate with

respect to any matter in the State List if a Proclamation of Emergency is in

Operation

4) Article 268- Duties levied by the Union but collected

and appropriated by the States

5) Article 269- Taxes levied and collected by the Union

but assigned to the States

6) Article 270- Taxes levied and distributed between the

Union and the States

7) Article 271- Surcharge on certain duties and taxes for

purposes of the Union

8) Article 286- Restrictions as to imposition of tax on

the Sale or Purchase of Goods

9) Article 366- Meaning of Goods and Services Tax(GST)

& Services

10) Article 368- Power of Parliament to amend the

Constitution and procedure therefore

11) Amendment to Sixth Schedule to the Constitution

12) Amendment to Seventh Schedule to the Constitution

Omission of Articles

Article

268A- Service tax levied by Union and collected and appropriated by the Union

and the States