In short, the resulting gap between selling

price and market price constitutes under-recoveries.

Why are Under-recoveries controversial ?

- The

quantum of under-recoveries has been a matter of debate for some time

now.

- As

indicated by several committees, the current trade parity pricing method

of calculating under-recoveries, which assigns an 80 per cent weight to

refined product imports and 20 per cent weight to exports may be

overstating the actual burden.

- This

is because, although India imports most of its crude oil, it is an

exporter of refined products such as petrol and diesel, thanks to the

country's surplus refining capacity.

Result:

The under-recovery calculation formula loads import costs such as freight,

insurance, and customs duties on refined products, which may not have been

incurred in the first place.

- Also,

under-recoveries are often confused with losses.

- While

under-recoveries would be incurred if sale price is less than market rates

(which includes margins), loss would be incurred if sale price is less

than cost. In effect, OMCs may be bearing a portion of the under-recovery

burden, yet manage to post profits , as seen in fiscal 2010. Of course, if

under-recoveries to be borne becomes too large, OMCs would slip into the

red.

More transparency in the under-recovery calculations would help

get a correct sense of the real burden.

*************************************************************

India's GoI-PSU Oil Complex

Who the players are, and their role in fuel subsidy

'Upstream' Companies

·

These include companies such as ONGC and OIL, which supply crude to the oil

marketing companies.

· Importantly, they also bear a

significant part of the fuel subsidy by giving discounts on the crude they sell

to the refiners.

· In 2011-12, for instance, such

discounts accounted for about 40% of the total assistance to oil companies.

Oil Marketing Companies

·

The 'refiners-cum-marketers' companies like IOC, BPCL and HPCL(called 'OMCs') buy crude from

upstream companies, and refine it into diesel, petrol and other 'products'.

· The 'refinery' arm of the OMC

then sells it to the marketing arm of the OMC at the international benchmark

price, which sell it to the end-customer.

· By selling at controlled

prices, the marketing arm of OMCs sustain a loss.

Central Government

·

Mobilised about Rs 83,700 crore in taxes on various fuel products

in 2011-12.

· The total subsidy payout, on

the other hand, to the oil companies to compensate them for under-recoveries,

was about Rs 70,000 crore.

· In 2011-12, it bore around half

the total 'under-recoveries' of oil companies.

Recent development !

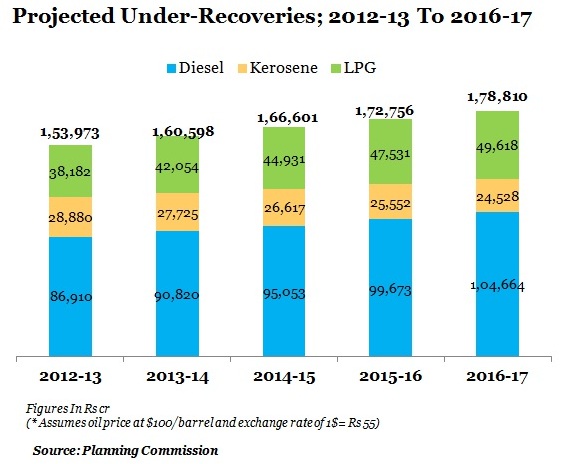

Under recoveries on diesel to end by mid-2015 : Planning

Commission -

(Note -- Figures are of 2011-12 ....for understanding the concepts ! )