This is all you wanted to know series which I have started in which 10 topics will be discussed on YOUTUBE ..although I am also sharing the content in text form for convenience !!!

#1. Babasaheb Ambedkar

#1. Babasaheb Ambedkar

1.

Bahishkrit Hitakarini

Sabha was the first

organization formed by Dr. Ambedkar in 1924.

2.

The First Round Table

Conference was convened in London on November 12, 1930. The depressed classes

were represented by Dr. B.R. Ambedkar and Rao Bahadur Srinivasan.

3.

Ambedkar formed the Independent Labour Party (ILP) in

August, 1936, which participated in

the provincial elections of Bombay and won 13 seats out of 15 seats reserved

for scheduled castes. Independent Labour Party was transformed by Ambedkar as

the All India Scheduled Castes

Federation in 1942. It was a political

party which participated in the general elections of 1946 but was completely

defeated.

4.

Ambedkar was opposed to

the strike by civil servants. For

him strike is nothing more than a breach of contract of service. It is only a

civil wrong not a crime.

5.

In July 1942, Ambedkar

was appointed the member of Executive Council of Viceroy as a Labour

member. He resigned from this post in May 1946.

6.

In January, 1920,Ambedkar

had also started a weekly paper called ‘Mooknayak‘

(Leader of the Dumb) to champion the cause of the depressed classes in India.

7.

Some of his famous books

include-The Untouchable: Who are They and Why They Have Become

Untouchables; Buddha and His Dhamma; ‘The Rise and Fall of Hindu Women‘, ‘Emancipation of Untouchables’, ‘The Evolution of Provincial Finance in British India’; ‘Pakistan or Partition of India‘, ‘Thoughts on Linguistic States’, etc.

8.

Ambedkar was appointed as the first Law Minister of Independent India, but he resigned from the Cabinet on September 1951 due to differences

with Nehru on the Hindu Code Bill.

9.

Ambedkar was first

elected to the Constituent Assembly from Bengal but he lost his seat after the

partition. However, he was chosen

by the Bombay Congress Legislative Party in place of M.R. Jaykar who resigned

earlier. It should be noted that he was defeated earlier in the election of

Constituent Assembly in Bombay. It is interesting to note that in

his interview with Cabinet Mission on April 5, 1946, Ambedkar opposed the idea

of Constituent Assembly as he feared it would be dominated by High Caste

Hindus.

10.

Ambedkar was elected as

the Chairman of the Drafting Committee of the Constituent

Assembly. He is called the father of the Indian Constitution.

However, K.V. Rao was of the

opinion that Ambedkar was not the father but mother of the Indian

Constitution as the vital

decisions about the Constitution were taken by Nehru and Patel, and Ambedkar

followed the same.

11.

Ambedkar was defeated in

the election to the Lok Sabha in 1952 mainly due to his advocacy of partition

of Kashmir. However, he was elected as a member of Rajya Sabha from Maharashtra

in March 1952. In May 1954, he again contested in the by-election to Lok Sabha

but was defeated again. He realised that a party which has no base in rural

areas has no future.

12.

Ambedkar

considered the Right

to Constitutional Remedy as the Soul of the Constitution and Union of India as “indestructible union of

destructible states”.

13.

Ambedkar converted to Buddhism

on October 14, 1956. He died on December 6, 1956 at Delhi due to severe

diabetic neurosis.

14.

After

his death, his political party Scheduled Caste Federation was renamed as Republican Party of India in 1957 by his

followers.

--------------------------------------------------------------------------------------------------------------------------

#2 Masala Bonds

Masala bonds are rupee denominated overseas

bonds. Here are key notable points about Masala Bonds.

·

Such

bonds are Rupee denominated. When an Indian company issues Rupee denominated

Bond, it is obviously shielded against the risk of

currency exchange rate aberrations. The foreign exchange risk is

on foreign investors rather.

·

The key

advantages of Masala Bonds are as follows:

·

Firstly, they help to internationalize the Indian Rupee and deepen Indian

Financial system.

·

Secondly, they diversify the funding resources of Indian

companies.

·

Thirdly, they may help to bring down the cost of borrowing and cost of

capital.

·

Fourthly, allowing Masala Bonds is considered to be a small step towards

full convertibility of Rupee.

·

Fifthly,

such bonds would support towards stability of rupee.

·

First

Masala Bond was issued by International Finance Corporation (IFC) in 2013. So

far, no Indian company has released such Bonds.

·

The

analogous bonds of China are called “Dim sum” while those of Japan are called

“Samurai” bonds.

·

The

Indian companies are allowed to raise a maximum of $750 million per year

through masala bonds with a minimum maturity of five years.

-----------------------------------------------------------------------------------------------------------------------------------

#3 Project Saksham

The Project SAKSHAM is a New Indirect Tax Network (Systems

Integration) of the Central Board of Excise and Customs (CBEC).

It seeks to bolster the information technology network for the

new Goods and Services Tax (GST) regime that the Union Government intends to

roll out from 1st April 2017.

The Project SAKSHAM will help in

·

Integration of CBEC IT

systems with the Goods and Services Tax Network (GSTN).

·

Extension

of Indian Customs Single

Window Interface for Facilitating Trade (SWIFT)

·

Other taxpayer-friendly

initiatives under Digital India and Ease of Doing Business of CBEC.

Background

·

With the implementation of

GST, the Union government expects the number of taxpayers under indirect tax

laws to increase to about 65 lakh from the

current 36 lakh.

·

CBEC’s IT systems need to

integrate with the GSTN for processing of registration, payment and returns

data sent by GSTN systems to CBEC.

·

It will also act as

a front-end for other modules like audit, appeal and investigation.

However, there is no overlap in the GST-related systems of GSTN and CBEC.

·

IT infrastructure is also

required for continuation of CBEC’s e-services in customs, central excise and

service tax, implementation of taxpayer services, extension of SWIFT initiative

and integration with government initiatives such as e-Taal, e-Nivesh

and e-Sign.

------------------------------------------------------------------------------------------------------------------------------------

#4 Project Insight

The Income Tax department is planning to implement the

first phase of ‘Project Insight’ from May 2017 to monitor high

value transactions, with a view to curbing the circulation of black money.

This project has been initiated for data mining, collection,

collation and processing of such information for effective risk management with

a view to widening and deepening tax base.

Key Facts

·

‘Project Insight’ is an integrated

platform that will utilize

vast amount of information easily available on social media to conduct raids

online rather than traditional way of conducting random searches, known as tax

raids.

·

It will use data mining, big data and analytics to scoop out tax evaders from

social media platforms like Facebook, Twitter and Instagram.

·

The Permanent Account

Number (PAN) will be the unique identifier is used by the Income Tax department

to link and analyse various transactions relating to the tax payers.

·

This will enhance the

department’s ability to monitor the flow of funds and will provide an audit

trail of high value transactions and curb circulation of black money

·

The ‘Project Insight’ will be implemented in phased manner during the

period 2016-2018. For its implementation,

the IT department has signed a contract with L&T Infotech Ltd.

·

It will also be leveraged

for implementation of Foreign Account Tax Compliance Act Inter

Governmental Agreement (FATCA IGA) and Common Reporting Standard (CRS).

Significance of ‘Project Insight’

·

It will help in catching

tax evaders in a non-intrusive manner using technology and without traditional

intrusive methods like search and seizure.

·

The integrated platform

will play a key role in widening of tax base and data mining to track tax

evaders.

·

The reporting compliance

management system of project will ensure that third party reporting by entities

like banks and other financial institutions is timely and accurate.

·

It will also set up a

streamlined data exchange mechanism for other government departments.

-------------------------------------------------------------------------------------------------------------------------------------

#5 First Titanium Project in

India

The first titanium project of India has started its test

production Ganjam district of Odisha. The project has been established by Saraf

Group.

This is first of its kind titanium plant and the only one in the

country. During the test run, one of its four furnaces became functional.

Key Facts

·

After inception, this

plant is expected to produce 36,000 tons of titanium slag and 20,000 tons of

pig iron per year.

·

The raw material of the

plant ilmenite would be procured from Odisha Sands Complex

(OSCOM), a unit of Indian Rare Earths Limited (IREL) in Ganjam district of

Odisha as well as a private company which has its unit in Srikakulam in Andhra

Pradesh.

Earlier in August 2015,

Indian Space Research Organisation (ISRO) had fully commissioned and started

commercial production at the first indigenous Titanium Sponge Plant at Chavara

in Kerala. This plant had commercially started producing Titanium Sponge

exclusively for the space programme and strategic areas especially in aerospace

and defence areas. With this commissioning India became the seventh country in

the world producing Titanium sponge commercially.

--------------------------------------------------------------------------------------------------------------------------------

#6 FASTag

- On

31st October 2014, Central government started FASTag

Electronic Toll Collection (ETC) across 45 toll plazas on the Mumbai-Delhi

corridor on the Golden Quadrilateral..

- FASTag

ETC is an advanced programme for making the payment electronically on

highway tolls without stopping the vehicle at the toll plazas.

- This

system will remove logistic inefficiencies at toll plazas and has the

potential of saving Rs 60,000 crore in terms of time and fuel

bills.

- Centre

has asked state governments to come forward and adopt this system and use

it free of charge.

How FASTag Electronic Toll

Collection (ETC) system works?

·

Under ETC system,

vehicles will be affixed with a prepaid ‘Radio Frequency

Identification Device’ tag known as FASTag. It will be fixed on

the wind shield of the vehicle.

·

The RFID Tag on

windshield will be read by the readers fitted in the dedicated ETC

lanes of toll plazas after vehicles passes through toll plazas.

·

After the entry of

vehicle passing through toll plaza is done, ETC will deduct an appropriate

amount depending upon the class of vehicle from the account of the user. Thus,

complete process of payment will be automated.

·

The prepaid accounts will

be created at the Central Clearing House set up

by banks and their franchises or agents and at point of sales near the toll

plazas.

Similar highway tag brands are available in developed countries

with different names like

·

Eazee Pass, SunPass in the

US.

·

e-Passin Australia.

·

Salik in Dubai.

-------------------------------------------------------------------------------------------------------------------------------------

#7 TRINETRA

The Indian Railways has initiated process to launch the Terrain

Imaging for Diesel Drivers- Infrared Enhanced Optical and Radar Assisted

(Tri-NETRA) system to avoid train accidents.

The system will be installed on locomotives for enhancing the

vision of Locomotive Pilots in inclement weather.

Key Features of Tri-NETRA system

·

The device uses infrared

and radar technology to collect signals up to a distance of 2-3 km and

displays the information (composite video image) on a screen fitted inside the

locomotive.

·

The Tri-Netra will alert

the drivers of any physical obstruction on railway tracks ahead and thus give

ample time for the driver to apply the brakes to prevent train accidents.

·

It will be very useful

during fog, heavy rain and nights, when drivers have to constantly look outside

the locomotive to judge the condition.

·

Three

components of the system: It

is made of high sensitivity infra-red video camera, high-resolution optical video camera

and a radar-based terrain mapping system. These three components shall act as three eyes

(Tri-Netra) of the Locomotive Pilot.

Background

·

The concept of TRI-NETRA

was developed by Development Cell under the guidance of Member Mechanical,

Railway Board.

·

Specifications and design

of critical components of the system will be approved by the Research Designs

& Standards Organisation, the railways research arm.

·

TRI-NETRA system is based

on technology employed by fighter aircrafts to see through clouds and operate

in pitch darkness.

·

It is also based

technology used by naval ships in mapping the ocean floor and navigating in the

night.

----------------------------------------------------------------------------------------------------------------------------------

#8 FAME INDIA Scheme

Union Government on 1 April 2015 launched Faster Adoption and Manufacturing of Hybrid and Electric vehicles

(FAME) – India Scheme.

The scheme was launched as part of the National Mission for

Electric Mobility to boost eco-friendly vehicles sales in the country.

Facts about FAME India scheme

·

Objective- to support the hybrid or electric vehicles market development

and its manufacturing eco-system in the country in order to achieve

self-sustenance in stipulated period.

·

The overall scheme is

proposed to be implemented over a period next 6 years i.e. till 2020.

·

It envisages providing Rs

795 crore support till 2020 for the manufacturing and sale of electric

and hybrid vehicles.

·

It also seeks to provide

demand incentives to electric and hybrid vehicles from two-wheeler to buses.

·

Implementation- It will be implemented in phases. The Phase-1 will be implemented over

a two year period in FY15-16 and FY16-17.

·

Based on the outcome and

experience from the Phase-1, it will be reviewed for implementation after 31

March 2017. Then appropriate fund will be allocated for future.

·

Four focus areas of

scheme-

Technology

development, Pilot Projects, Demand Creation and Charging Infrastructure.

·

In the first two years Rs

260 crore and Rs 535 crore will be spent on the focus areas.

The Department of Heavy

Industries under the aegis of Union Ministry of Heavy Industries will be will

be nodal department for the scheme.

---------------------------------------------------------------------------------------------------------------------------------

#9 Project Sankalp

------>>> The

Department of Pension & Pensioners’ Welfare has initiated scheme in January

2014, “Sankalp” which aims at

channelizing skill, experience and time available with retired government

servants into meaningful, voluntary contribution to society. This would add to the social capital of the country and at

the same time restore dignity and purpose to life post-retirement.

------>>>

HIV awareness -- 2008

-----------------------------------------------------------------------------------------------------------------------------------

#10 Anekantavada

- Anekāntavāda meaning “non-absolutism,” is one of the basic

principles of Jainism that encourages acceptance of relativism and

pluralism.

- According to this doctrine, truth and reality

are perceived differently from different points of view, and no single

point of view is the complete truth.

·

Anekāntavāda is literally the

doctrine of “non-onesidedness” or “manifoldness;” it is often translated as “non-absolutism.”

·

As opposed to it, ekānta (eka+anta “solitary attribute”) is one-sidedness.

·

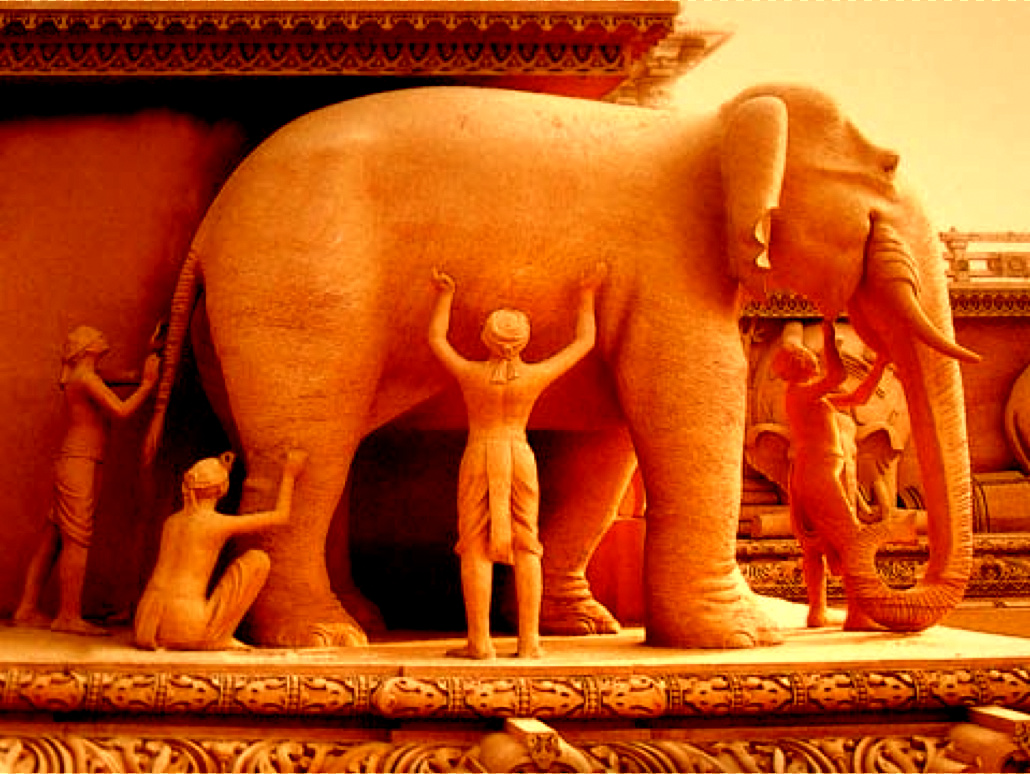

Jains compare all attempts

to proclaim absolute truth with adhgajanyāyah or

the “maxim of the blind men and

elephant.”

·

In this story, one man felt

the trunk, another the ears and another the tail. All the blind men claimed to

explain the true appearance of the elephant, but could only partly succeed, due

to their narrow perspectives.