OPEC :

A. Origin :

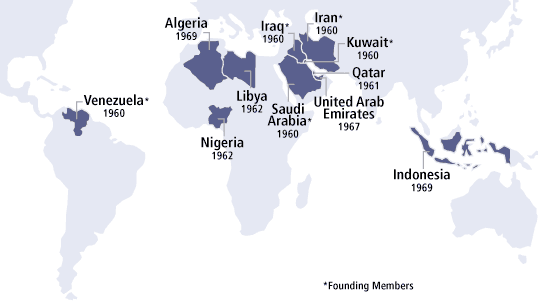

The Organisation of Petroleum Exporting Countries

(OPEC) is a permanent intergovernmental organisation which was formed at the

Baghdad Conference of September 1960, by Iran, Iraq, Kuwait, Saudi Arabia and

Venezuela.

B. Members :

B. Members :

|

Iran, Iraq, Kuwait, Saudi Arabia, Venezuela,

Qatar, Indonesia, Libya, United Arab Emirates, Algeria and Nigeria. Saudi

Arabia is the biggest producer of oil and the dominant partner in the cartel.

C. 40% Share in Global Oil Supplies :

The OPEC supplies over 40 per cent of the world|s

oil need. Between them the OPEC members have around three-fourths of the

World|s proven oil reserves. Excluding Iraq OPEC has a total production

capacity of 28.7 million barrels per day (Mb/d). The global demand for oil is around

80 Mb/d.

D. OPEC's Control of Global Oil Prices :

D. OPEC's Control of Global Oil Prices :

- Controlling Oil Prices by Restricting Production:

Analysts point out that OPEC tries to control global oil prices by

restricting the production.

- When the cartel feels that the oil prices are low, the

Oil Ministers of OPEC nations impose production ceilings.

- Lower supplies send oil prices up.

- In 1973, OPEC|s squeeze on supply of oil quadrupled oil

prices almost overnight.

E. OPEC's Price Band Mechanism :

- The OPEC introduced a price band mechanism that targeted

a price range of $22-28 per barrel for the OPEC basket, with automatic

adjustments to quotas if the range was breached.

- Over the last one year, the OPEC basket price has

remained well above its stated price limits.

F. OPEC a Divided House :

- OPEC has been a divided house with a big gap between

advocates of production cuts and higher prices and moderates advocating

high production and low prices.

G. Limitations of OPEC|s Control Exposed :

- The spurt in global oil prices exposed the limitations

of the OPEC.

- Several members of the OPEC could barely manage their

quotas, let alone increase production to stabilise the spurt in the oil

prices.

2. Non-OPEC Oil suppliers :

A. Countries with Substantial Reserves : Russia, Mexico, Angola, Oman, Norway and Britain.

|

B. Russia the Largest Non-OPEC Oil Producer :

- Since

1997, when Russian crude production began to pick up and its exports into

global markets began picking up, non-OPEC producers have made inroads into

OPEC|s global market share.

- Russia

is one of the largest producers of oil outside OPEC in the world.

3. Spurt in International Oil Prices :

A. Large Increase in International Crude Oil Prices :

- There

has been a sharp increase in the prices of crude oil in the last few

years.

- Annual

average crude oil prices have increased from $21.74 in 2002 to around $ 72

in 2007.

- Currently

the price of crude oil is hovering around $120 per barrel.

B. Reasons for Increase in the Oil Prices :

a. Increase in Demand from the US and China :

- The

major factors behind the increase in global demand for oil was the

increase in consumption levels in the US and China.

- The

booming economy of China was the key factor for increased consumption of

oil by China.

b. Weak Dollar :

- Analysts

point out that oil prices are benchmarked in US dollars which has been

depreciating.

- The

fall in the value of dollar robbed it of its purchasing power which

encouraged the OPEC to take a relaxed view about the situation as the

cartel|s revenues are pegged to the dollar.

c. OPEC's Refusal to Increase Production :

- One

of the reasons for increase of crude oil prices in 2007 was the refusal by

OPEC to increase production to meet the rising demand.

d. Speculation :

- Analysts

point out that speculators made big bets on the future delivery of oil

which was one of the causes of the sharp increase in global oil prices.

e. Investment Flows into Oil :

- Analysts

point out that the flow of investments from pension and hedge funds into

commodities including oil have increased leading to the surge in crude oil

prices.

f. Concern over Supply Disruptions from Iran :

- Oil

consumers are concerned about the supply disruptions from Iran which is

locked in a confrontation with the West over its nuclear programme.

g. Poor Supply from Iraq :

- The

oil industry in Iraq is still struggling to reach peak production after

decades of war, sanctions and under investment.

h. Cut in Supply from Nigeria :

- Crude

oil production has been cut in Nigeria since February 2006 due to militant

attacks on the country|s oil industry.

4. Global Economic Impact of the Rise in Oil Prices :

A. Increase in Inflationary Pressures : According to analysts the increase in global oil prices added to the inflationary pressures in various countries.

B. Increase in Interest Rates : Economists point out that a mismatch between global oil price and domestic selling price can push up the subsidy from the government and public debt which in turn can put pressure on interest rates and reduce the capital available to more productive borrowers.

C. Slowdown in Economic Growth : Increase in oil prices coupled with inflationary pressures will slowdown the economic growth in these countries. The World Bank has already revised the economic growth projections in these countries by reducing one percentage point.

D. Not a Full-fledged Oil Crisis :

- Analysts

point out that the current rise in oil prices is not a full-fledged oil

crisis on the lines of the 1970s and 1980s.

- The

reasons being the developed countries are now less dependent on oil than

they were in 1979.

- Adjusted

for inflation the crude oil prices are still below the $101.70 peak

reached in 1980, a year after the Iranian revolution.

5. OPEC to Keep the Crude Output at Current Levels:

- Despite

pressure from the US and other countries to increase production, the OPEC

special meeting in Vienna in February 2008 decided to keep the crude oil

production at the current levels of around 30 million barrels a day.

6. Conclusion :

A. Equilibrium between Demand and Supply Key to Price

Stabilisation :

- Analysts

point out that global oil prices are affected by long-term factors one of

which is the equilibrium between supply and demand.

- Analysts

point out that the oil demand has not been responsive to prices.

B. Stabilising the Oil Prices is in the Interest of OPEC :

- Finally,

analysts point out that it is in the interest of the OPEC countries to

keep the global oil prices at manageable levels as higher prices will push

the consuming countries into recession, leading to reduced demand for oil

and a price crash.

The idea of developing shale oil and gas, mainly by the U.S.

and Canada, has galvanised the geopolitics of the energy market ?

Shale gas is a natural gas found trapped

in shale formations. Shale gas share in US natural gas market has increases

considerably over last decade ( from 1% in 2000 to 20% in 2010) and is expected

to account for 46% share by 2035.

|

| Shale gas reserves |

Effect on Geopolitics in energy market

• Cut in international oil prices which has fueled up over last decade thanks to high growth(high energy demands) of China.

• Shale gas which has been extracted

hitherto mostly in North America is likely to move to countries like China, Argentina,

Ukraine etc. As per US EIA agency China has the largest estimated recoverable

shale gas estimates in the world followed by Argentina and Algeria.

• America’s self sufficiency in Oil will

put pricing pressures on oil producers as US will not be interested in

importing oil from Gulf area.

• China has two geostrategic reasons to

produce Shale gas. First, huge estimated reserve . Secondly, as China imports

LNG through Pacific Ocean which is controlled by US Navy, so there is always a

fear of US blockade.

• It is a setback for Russia and Gulf countries as their economy is mostly dependent on oil and gas exports which can see sharp decline, once the technology ( Horizontal drilling and hydraulic cracking) of shale gas production is used full fledgedly by other countries.

What happens with OPEC now ?

- Since its inception in 1960, OPEC has never been shy in flexing its energy-fuelled power over the West. But those days are done. To put it bluntly, you could say that OPEC power has been well and truly fracked.

- And it’s not just the US and Israeli shale gas and oil revolutions which threatens OPEC’s decline. OPEC is already grappling with a whole bunch of serious energy problems that are colluding to hasten its demise.

- OPEC itself has been forced to downgrade its economic prospects. OPEC’s World Oil Outlook anticipates a decline in global demand for its oil to 2016 with production falling to 29.7 mpbd. That’s a drop of 1.6 mbpd from the forecast just a year ago. For the moment, much of the consequent fall in demand from the West is likely to be offset by a rise in demand from Asia, especially China and India. But the real fear for the Saudis and for OPEC’s members generally is what would happen to OPEC once US shale fracking technologies are exported worldwide.

- China’s domestic shale gas and oil reserves may potentially far outstrip even those of the United States. So why import from the Middle East when a bonanza of oil and gas is right under your own feet? All the signs are that both China and India intend to invest heavily in shale development at home.

- These issues are precisely why we have been hearing so much of late about the Saudi Government’s attempts to diversify its energy operations, including the potential exploitation of its own shale gas and oil prospects. But one has to wonder where, in this desert kingdom, it expects to find the enormous quantities of water necessary for the fracking process. The annual water requirement for fracking operations in the West is somewhere between 70 billion and 140 billion gallons. The Saudis simply don’t have the water for that scale of energy production.

- Plainly, the days when OPEC could hold the West to political ransom – as it did when it ordered an oil embargo after the US supplied Israel with arms during the 1973 Arab-Israeli War – are over.

- Fracking may have signalled the collapse

of its power in the West, but OPECs inherent tyrannical despotism and

political hubris will only serve to hasten its global demise.