What is transfer price?

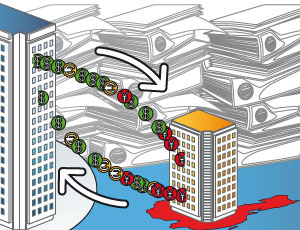

- The commercial transaction between various multinationals corporations(MNCs) or groups or independent units of same organisations may not subject to market forces.

- One party or group or unit transfers to another goods,services at some price.

- This price is called 'Transfer price(TP)'.

- Profit or loss may not be taken into consideration while deciding TP.

- TP may be dictated or arbitrary independent of market forces.

Transfer Pricing refers to prices of

transaction between associated enterprises which may take place under

conditions different from those taking place between independent enterprises.

- It refers to the value attached to transfers of goods, services and technology between related entities.

- It also refers to the value attached to transfers between unrelated parties which are controlled by a common entity.

Let us

consider an example.

Suppose there are two companies parent company

A and its subsidiary company B.

- A purchases goods for 1 lakh and sell it to B for 2 lakh .

- B sells the same goods for 7 lakhs.

- Here B earns a profit of 5 lakhs.

If A would have decided to sell goods directly

A would have earned 6 lakhs.

But A restricted itself to the profit of 1 lakh

only and given chance to B to appropriate the profit.

Thus the transaction between A and B is

arranged and not governed by market forces.

- Here TP is 2 lakh i.e price fixed by A to sell goods to B.

- Arm length Price(AP) is 7 lakhs at which B sells goods.

Let's see why it is done and what are its

implications...

- Here let us suppose parent company A resides in country India where taxes are more and subsidiary B resides in tax haven Mauritius where taxes are less.

- Now the profit earned by A by direct selling goods would have attracted high taxes but in above scenario A would show less income and hence subject to less tax.

- B would earn good profit as the tax on its income would be very less or no tax.Here A saved tax by using transfer pricing mechanism.

In this case the result is India has lost tax

revenue and drain on foreign reserves.

In nut shell this can be stated as

A group which manufacture products in a high tax countries may decide to sell them at a low profit to its affiliate sales company based in a tax haven country. That company would in turn sell the product at an arm's length price(AP) and the resulting (inflated) profit would be subject to little or no tax in that country. The result is revenue loss and also a drain on foreign exchange reserves.

Technical definition of

arm length price(AP)

“arm’s length price” means a price which

is applied or proposed to be applied in a transaction between persons other

than associated enterprises, in uncontrolled conditions;

In above example B would sell goods to local

markets in Mauritius at inflated price which is 7 lakhs.

Why is

it bad?

- Though transfer pricing is not illegal, but concerns are growing in number of countries that large corporations are not paying their fair share of taxes.

- In a recent article in The Guardian, Nobel Price wining economist Joseph Stiglitz while stressing on the point in favour of a global deal to stop multinationals from taking advantage of rules noted:

- “Our multinationals have learned how to exploit globalization in every sense of the term—including exploiting the tax loopholes that allow them to evade their global social responsibilities.”

- Number of countries are not only working to plug the loopholes in tax laws but are also strengthening transfer pricing monitoring systems.

****************************************************************

Recent NEWS --- Current Affairs

New transfer

pricing rules to lessen tax disputes

The rules will give multi-national companies and the domestic companies having subsidiaries abroad to come for tax estimation with the authorities in advance. The income-tax authorities will not question the pricing of transactions between multinational companies and their subsidiaries under certain situations, which will benefit a host of sectors such as IT and ITES (Information Technology Enabled Services), pharmaceuticals and automobiles.

|

*****************************************************************

Additional Reading :: Miscellaneous !!