Understanding Financial Markets

1. What

are the various types of financial markets?

The financial markets can broadly be

divided into money and capital market.

Money Market:

- Money

market is a market for debt

securities that pay off in the short term usually less than one year, for example

the market for 90-days treasury bills.

- This

market encompasses the trading and issuance of short

term non equity debt instruments including treasury bills, commercial papers, bankers

acceptance, certificates of deposits, etc.

Capital Market:

- Capital

market is a market for long-term debt and equity shares.

- In

this market, the capital funds comprising of both equity and debt are

issued and traded.

- This

also includes private placement sources of debt and equity as well as

organized markets like stock exchanges.

- Capital

market can be further divided into primary and secondary markets.

2. What is meant by

Secondary Market?

- Secondary

Market refers to a market where securities are traded after being

initially offered to the public in the primary market and/or listed on the

Stock Exchange. .

- Majority of the trading is done in the secondary

market.

- Secondary market comprises of equity markets and the debt

markets.

For the general investor, the secondary

market provides an efficient platform for trading of his securities. For the

management of the company, Secondary equity markets serve as a monitoring and

control conduit—by facilitating value-enhancing control activities, enabling

implementation of incentive-based management contracts, and aggregating

information (via price discovery) that guides management decisions.

3. What

is the difference between the primary market and the secondary market?

- In

the primary market, securities are offered to public for subscription for

the purpose of raising capital or fund.

- Secondary

market is an equity trading avenue in which already existing/pre- issued

securities are traded amongst investors. Secondary market could be either

auction or dealer market.

- While

stock exchange is the part of an auction market, Over-the-Counter (OTC) is

a part of the dealer market.

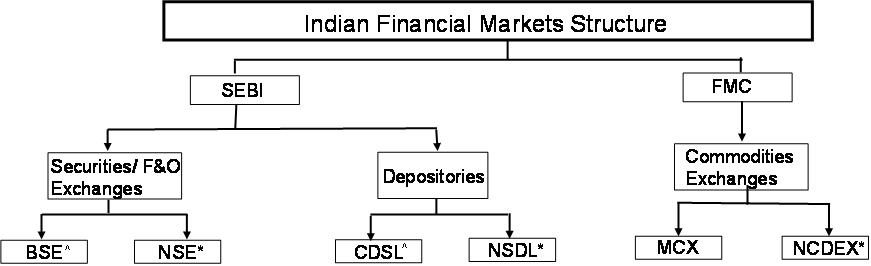

SEBI and its Role in the Secondary Market

4. What is SEBI and

what is its role?

The SEBI is the regulatory authority

established under Section 3 of SEBI Act 1992 to protect the interests of the

investors in securities and to promote the development of, and to regulate, the

securities market and for matters connected therewith and incidental thereto.

5. What

are the various departments of SEBI regulating trading in the secondary market?

The following departments of SEBI take

care of the activities in the secondary market.

|

Sr.No.

|

Name of the Department

|

Major Activities

|

|

1.

|

Market Intermediaries Registration and

Supervision department (MIRSD)

|

Registration, supervision, compliance monitoring and

inspections of all market intermediaries in respect of all segments of the

markets viz. equity, equity derivatives, debt and debt related

derivatives.

|

|

2.

|

Market Regulation Department (MRD)

|

Formulating new policies and supervising the

functioning and operations (except relating to derivatives) of securities

exchanges, their subsidiaries, and market institutions such as Clearing and

settlement organizations and Depositories (Collectively referred to as

‘Market SROs’.)

|

|

3.

|

Derivatives and New Products

Departments (DNPD)

|

Supervising trading at derivatives segments of stock

exchanges, introducing new products to be traded, and consequent policy

changes

|

Products available in the Secondary Market

6. What are the

products dealt in the secondary markets?

Following are the main financial

products/instruments dealt in the secondary market:

Equity: The ownership interest in a

company of holders of its common and preferred stock. The various kinds of

equity shares are as follows:-

Equity Shares:

An equity share, commonly referred to as

ordinary share also represents the form of fractional ownership in which a

shareholder, as a fractional owner, undertakes the maximum entrepreneurial risk

associated with a business venture. The holders of such shares are members of

the company and have voting rights.

- Rights

Issue / Rights Shares: The issue of new securities to existing

shareholders at a ratio to those already held.

- Bonus

Shares: Shares

issued by the companies to their shareholders free of cost by capitalization of

accumulated reserves from the profits earned in the earlier years.

- Preferred

Stock / Preference shares: Owners of these kinds of shares are

entitled to a fixed dividend or dividend calculated at a fixed rate to be

paid regularly before dividend can be paid in respect of equity share.

They also enjoy priority over the equity shareholders in payment of

surplus. But in the event of liquidation, their claims rank below the

claims of the company’s creditors, bondholders / debenture holders.

- Cumulative

Preference Shares: A type of preference shares on which

dividend accumulates if remains unpaid. All arrears of

preference dividend have to be paid out before paying dividend on equity

shares.

- Cumulative

Convertible Preference Shares: A type of preference shares where the dividend

payable on the same accumulates, if not paid. After a specified

date, these shares will be converted into equity capital of the company.

- Participating Preference Share: The right of certain

preference shareholders to participate in profits after a specified fixed

dividend contracted for is paid. Participation right is linked

with the quantum of dividend paid on the equity shares over and above a

particular specified level.

- Security Receipts: Security receipt means a receipt or other

security, issued by a securitisation company or reconstruction company to

any qualified institutional buyer pursuant to a scheme, evidencing the

purchase or acquisition by the holder thereof, of an undivided right,

title or interest in the financial asset involved in securitisation.

- Government

securities (G-Secs): These are sovereign (credit risk-free) coupon

bearing instruments which are issued by the Reserve Bank

of India on behalf of Government of India, in lieu of the

Central Government's market borrowing programme. These securities have a

fixed coupon that is paid on specific dates on half-yearly basis. These

securities are available in wide range of maturity dates, from short dated

(less than one year) to long dated (up to twenty years).

- Debentures: Bonds issued

by a company bearing a fixed rate of interest usually payable

half yearly on

specific dates and principal amount repayable on particular date on

redemption of the debentures. Debentures are normally

secured / charged against the asset of the company in favour of debenture holder.

- Bond: A negotiable

certificate evidencing indebtedness. It is normally

unsecured. A

debt security is generally issued by a company, municipality or

government agency. A bond investor lends money to the issuer and

in exchange, the issuer promises to repay the loan amount on a specified

maturity date. The issuer usually pays the bond holder periodic interest

payments over the life of the loan. The various types of Bonds are as

follows-

Ø Zero Coupon Bond: Bond issued at a discount and repaid at a

face value. No

periodic interest is paid. The difference between the issue price and

redemption price represents the return to the holder. The buyer of these bonds

receives only one payment, at the maturity of the bond.

Ø Convertible Bond: A bond giving the investor the option to convert the bond into equity at a fixed conversion price.

- Commercial

Paper: A short

term promise to repay a fixed amount that is placed on the market either

directly or through a specialized intermediary. It is usually

issued by companies with a high credit standing in the form of a

promissory note redeemable at par to the holder on maturity and therefore,

doesn’t require any guarantee. Commercial paper is a money market

instrument issued normally for tenure of 90 days.

- Treasury

Bills: Short-term

(up to 91 days) bearer discount security issued by the

Government as a means of financing its cash requirements.