The first Budget by the new Government

has brought real estate investment trusts (REIT) back into the limelight.

Hailed as a ‘game changer’ for the Indian property market, REITs is an idea

that has been making its rounds since 2008 when SEBI first mooted them.

What are REITs ?

- REITs or Real

Estate Investment Trusts are

a special type of investment vehicle which operate more like mutual funds

but invest in real estate properties for returns.

- These properties are usually income

generating properties, commercial or residential, and the returns from

such investments are passed on to the investors in the REITs.

- Usually REITs' units, issued by fund

houses, are traded on the bourses and investors can buy and sell those

units like stocks.

- In several of the developed markets, REITs

are one of the most liquid investment products for investing in the real

estate sector even with a relatively low sum of money than the investor

would have if he/she had to invest directly in real estate.

- The various types of REITs include equity,

mortgage and hybrid ones.

Property held by REITs may also be sold and

reinvested in other assets. Any gains can go to unit holders. A principal

valuer will asses the property value every six months, and once a year by two

independent valuers.

In fact, REITs have been in existence for as

long as two decades in countries such as the US, the UK and Singapore.

Evolution of REITs in India ?

How REITs will be a game-changer for Indian real estate

REITs will establish a new asset class, and being a quasi debt-equity

instrument, be attractive for risk-averse investors get the twin benefits of

yield as well as capital appreciation. For developers, it would improve

property market transparency, smoothen volatile property cycles, and

potentially lower the cost of capital.

The Securities and Exchange Board of India (Sebi) recently announced guidelines for the creation of real estate investment trusts (REITs) in India. Just as mutual funds do with equity and debt, REITs will pool money from investors and invest them in income-generating (rental assets) offering them a way to diversify their portfolios by investing in property. After collecting money, REITs will issue units to investors, which will then be listed on exchange for buying and selling. This will help establish a new asset class, and being a quasi debt-equity instrument, be attractive for risk-averse investors get the twin benefits of yield as well as capital appreciation, an ICICI Securities report says. For developers, it would “improve property market transparency, smoothen volatile property cycles, and potentially lower the cost of capital.”

The Securities and Exchange Board of India (Sebi) recently announced guidelines for the creation of real estate investment trusts (REITs) in India. Just as mutual funds do with equity and debt, REITs will pool money from investors and invest them in income-generating (rental assets) offering them a way to diversify their portfolios by investing in property. After collecting money, REITs will issue units to investors, which will then be listed on exchange for buying and selling. This will help establish a new asset class, and being a quasi debt-equity instrument, be attractive for risk-averse investors get the twin benefits of yield as well as capital appreciation, an ICICI Securities report says. For developers, it would “improve property market transparency, smoothen volatile property cycles, and potentially lower the cost of capital.”

How will it help different stakeholders ?

Will Reits bring a respite to real

estate sector?

- Reits have been on the wishlist of the

Indian real estate sector for long. They are expected to bring in globally-accepted

practices to real estate funding and revive the interest of both global

and domestic investors in the sector.

- Reits will bring the much needed respite

to the commercial real estate sector and enable developers sitting on

assets to both unlock value and create liquidity. Globally, Reits are an

accepted investment avenue.

- Reits use investors' money to buy real

estate assets for rental and capital gains. These help buyers benefit from

real estate price appreciation without the hassles associated with buying

and maintaining properties. As Reits invest a large pool of money in

multiple properties, the investment risk is also diversified.

- Allowing Reits will be a sign of the

maturity of the Indian real estate market. Reits reduce individual

speculation in real estate assets and allow for more professional

investment and management in the sector

- If implemented, the timing of Reits will

be great as many developers are faced with liquidity issues as they have

large amounts of capital locked in commercial assets and are finding it

difficult to sell due to the large ticket sizes.

- Investments by Reits will also indirectly

reduce the exposure of banks to risky assets as they have provided

construction finances to many projects

The proposed structure

Each Reit will have a manager, sponsor and trustee. It will have a five-member investment panel.

Eligibility criteria for sponsors, managers

- Enough to keep non-serious players away, but seem loose

change for big realty companies such as DLF. The manager should have a net

worth Rs 5 crore, the sponsor Rs 20 crore.

- The manager is required to have five years’ experience

in fund management/ advisory services/property management in the real estate sector.

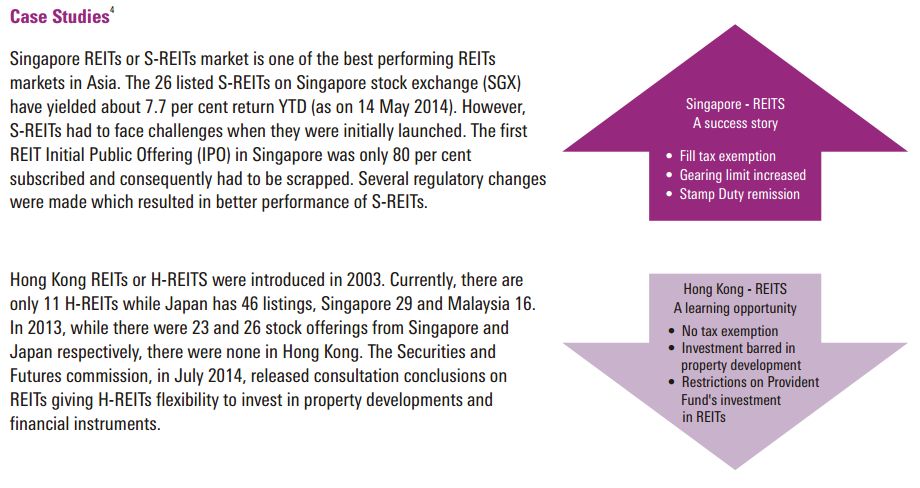

Case Studies