1. DIRECT TAX Bits

-No change in Income-Tax slabs

- Relief of Rs 2,000 for tax payers in tax bracket of Rs 2-5 lakh

- 10% surcharge on rich men with taxable income of over Rs 1 crore....(However

the surcharge is just for this year! Also it seems there are only 42,800 guys in

India who pay Tax above 1crore!

-New taxes (Direct+Indirect) to collect Rs 18,000 crore for government

2. INDIRECT TAXES

-No change in basic customs duty; normal excise and service tax rates unchanged at 12 per cent

-Voluntary Compliance Encouragement Scheme launched for recovering service tax dues.... PC said... if people pay tax they haven't for the last 5 years... their penalty, interest, fine will be maaf!

-Service Tax Negative list now includes vocational courses k institutes and Testing activities for agriculture k services

-Tobacco products, SUVs (except the ones used as Taxi) and mobile phones (above Rs.2000) to cost more. Also luxury cars, bikes and yatchs pe Excise Duty has been raised (Damn... pehle hi fancy cars kitne kum dikhte hai Mumbai mein)

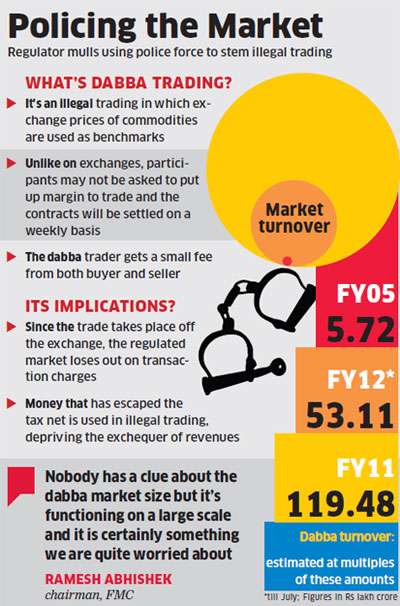

-Commodity transaction tax of 0.01% proposed on non-agri futures traded on commodity courses

-Securities Transaction Tax brought down to 0.01%

-Handmade carpets and textile floor coverings of coir or jute exempted from excise duty

3. The SCHEMES

- Direct Benefit Transfer scheme to be rolled out in the entire country during tenure of UPA government

-Income limit under Rajiv Gandhi Equity Savings Scheme raised to 12 lakh from Rs 10 lakh

-Rashtriya Swasthya Bima Yojana benefit extended to rickshaw pullers, auto and taxi drivers, mine workers, rag pickers, sanitation workers among others

-The Pradhan Mantri Gram Sadak Yojana PART 2 to be launched in AP, Haryana, Karnataka, Maharashtra, Punjab and Rajasthan

-TUF (Technology Upgradation Fund) Scheme for textile sector to continue in 12th Plan with an investment of Rs 1.51 lakh crore

-Rashtriya Madhyamik Shikshan Abhiyan to be alloted 25.6% more investment over the current RE

4. First home loan of up to Rs 25 lakh to get extra interest deduction of up to Rs 1 lakh!

5. Duty free limit of gold import increased to Rs 50,000 for male passengers and Rs 1 lakh for female passengers

6. India's FIRST women's bank to be set up by October 2013!

'Nirbhaya Fund' of Rs 1,000 crore to empower women and provide safety in the

wake of Delhi gang-rape incident

7.SOME NUMBERS

-Fiscal deficit for 2013-14 pegged at 4.8 % of GDP and 5.2 % in 2012-13.

-Revenue Deficit is expected to be 3.3% in 2013-14, for 2012-13 it was 3.9%

-Plan expenditure pegged at Rs 5,55,322 crore (33%) and non-Plan at Rs 11,09,975 crore

-Rs 14,000 crore earmarked for capital infusion in public sector banks in 2013-14

8. INSTITUTIONS

-There is gonna be reconstruction and development of the NALANDA University

-Grant of 100 crore to the Aligarh University, Banaras Hindu University, the Tata Institute of Social Sciences (Guwahati) and Indian National Trust of Art and Cultural Heritage each

-A National Institute for Sports Coaches will come up at PATIALA

-The National Institute of Biotic Stress Management for addressing plant protection issues --> Raipur, Chhatisgarh

- The Indian Institute of Agriculture Bio-technology will be estb. in Ranchi, Jharkhand

- National Skill Development Corporation to set the curriculum and standards for training in different skills. Any institution or body may offer training courses. At the end of the training, the candidate will be required to take a test conducted by authorised certification bodies. Upon passing the test, the candidate will be given a certificate as well as a monetary reward of an average of Rs.10,000 per candidate.

9. Refinance capacity of SIDBI (Small Industries Development Bank Of India) raised to Rs 10,000 crore

- LIC Insurance Offices in every town with a population above 10,000. Micro-Insurance and Group Insurance to be provided

- Farm credit target set at Rs 7 lakh crore as against Rs 5.75 lakh crore in 2012-13

-Concessional 6% interest on loans to weavers

10. MISCELLANEOUS

*To improve power supply in the Leh-Kargil region and connect the Ladakh region to the northern grid, the Government will construct a transmission system from Srinagar to Leh

*Two new major ports will be established in Sagar, West Bengal and in Andhra Pradesh to add 100 million tonnes of capacity

*The Lakhipur – Bhanga stretch of river Barak in Assam will be the sixth national waterway

*Private FM radio services to 294 more cities. About 839 new FM radio channels will be auctioned in 2013-14 and, after the auction, all cities having a population of more than 100,000 will be covered by private FM radio services

*Rs 9,000 crore earmarked as first installment of balance of CST compensation to states

*Defense allocation at Rs 203,672 crore, education Rs 65,867 crore and Rural Development Ministry Rs 80,194 cr

*Rs 10,000 crore earmarked for National Food Security towards incremental cost

*A pilot programme on Nutri-Farms for introducing new crop varieties that are rich in micro-nutrients such as iron-rich bajra, protein-rich maize and zinc-rich wheat

"Chidambaram says India to become USD 5 trillion economy, and among top

five in the world by 2025"

five in the world by 2025"